In our last article, we discussed the views of Howard Marks, Co-Chairman of Oaktree Capital. Howard expressed the view that low interest rates have driven down future return expectations across all asset classes. Today, I’d like to summarize the view from the Vanguard Group, including their forecasts for returns to various asset classes over the next the years.

In our last article, we discussed the views of Howard Marks, Co-Chairman of Oaktree Capital. Howard expressed the view that low interest rates have driven down future return expectations across all asset classes. Today, I’d like to summarize the view from the Vanguard Group, including their forecasts for returns to various asset classes over the next the years.

Summary of Pandemic Recovery

• ‘Covid-19 pandemic is accelerating trends such as work automation and digitization of economies’

• ‘The scarring effects of permanent job losses is likely to be limited’

• ‘Our fair-value stock projections continue to reveal a global equity market that is neither grossly over-valued nor likely to produce outsized returns going forward’

The Vanguard team believes that there will be shifts in the specific industries, but that for the most part at the country level they see GDP returning to pre-Covid-19 levels by 2021. In the US, they forecast growth of 5% over 2010. For China, the 9% growth as China is first to recover.

The stock valuation model that Vanguard uses relies on both current macroeconomic variables such as interest rates, but also on historical returns and valuations. The model is called the Vanguard Capital Markets Model. The data found in the articles referenced are from simulations at the end of September.

Fixed Income Outlook

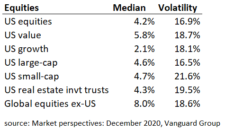

The estimates from Vanguard assume inflation may see a short term increase due to stimulus but over time will average 1.4% over the ten-year period. Forecasts for returns in fixed-income markets remain low compared to pre-pandemic levels.

The US aggregate bond market is forecasted to return just 1%, which would result in a negative real rate of return of -.4% after subtracting inflation. High yield and foreign sovereign bonds offer more attractive returns, but with higher risk.

Given the compressed return environment for fixed income, all things being equal we tend to favor low-risk stocks with good earnings yield and/or dividends in this environment.

Equity Markets

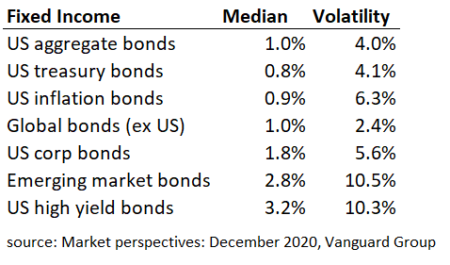

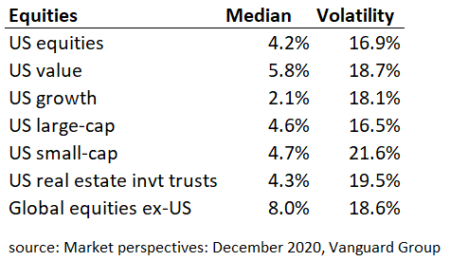

Vanguard’s team is forecasting US equities to generate 4.2% return for their median case over ten years. This represents an equity risk premium over aggregate bonds of 3.2%. This estimate is roughly in the middle of the range of estimates I am seeing from a range of sources.

Notable in Vanguard’s estimates are returns opportunities in several areas. First, they see better opportunity in US value stocks over US growth stocks. The Vanguard team asserts that the decades long outperformance to growth stocks has been driven by long term reduction in interest rates and inflation. From a theoretical point of view, the idea is that discounted cash flows from a growth company will increase faster as longer dated earnings are discounted at a lower rate. In addition, growth stocks are at a long-term peak relative to growth stocks.

Secondly, Vanguard see’s significantly better return opportunities in international stocks. The forecast here is 8%. I’d like to see Vanguard break out emerging market vs. international developed markets to get a bit more granularity. However, the Vanguard team went into some amount of detail describing where they see international stock returns compared to US. For example, they see PE compression hurting US stocks. Also, higher dividends in international markets are noted. Finally, the Vanguard team forecasted a .3% per year return to international stocks based on currency performance. The forecasts were made in September and in Q4, the US dollar substantially weakened vs. foreign currencies. Roughly speaking, the US dollar is now at a 2.5 year low vs the Euro. Some have argued that this is caused by concern over the US stimulus response to Covid. This may be. The US stimulus relative to GDP is twice as large as other developed countries.

Conclusions

Vanguard’s outlook is consistent with the framework discussed by Howard Marks. Future returns are expected to be compressed, largely driven by the low interest rate environment. Vanguard lays out a pretty compelling case for US value stocks and international markets as being relatively more attractive at this point. For these reasons, we will be increasing our portfolio weights to value and international developed markets going into 2021.

End notes

Market Perspectives: December 2020. The Vanguard Group. Published November 25, 2020.

Vanguard economic and market outlook for 2021: Approaching the Dawn. Vanguard Research, December 2020