This time of year, we put heavy focus on developing assumptions for future market returns and adjusting our model portfolios. The process is complex, but boiling it down we build a composite view based on a wide range of expert opinions on the economy and markets from experts such as JP Morgan, Fidelity, Vanguard and so on.

One of my favorite experts on the markets is Howard Marks, CFA and Co-Chairman of Oaktree Capital Management. Oaktree has been in business since the mid-nineties. Howard is known for publishing insightful newsletters that are well known in the industry. https://www.oaktreecapital.com/insights/howard-marks-memos

In Howard’s latest memo, he set about explaining why the market has reached new highs in the face of Covid cases rising. His explanation is, I believe, core to understanding how we should be looking at returns going forward. I’d like to summarize the key points here.

Background

Howard starts by explaining that the immediate reaction by the Federal Reserve to the pandemic was to drop interest rates. Prior to the Fed action, the benchmark US treasury bond rates were in the 2 – 2.5% range. The Federal Reserve has the power to control interest rates by buying and selling bonds. To reduce interest rates, the Federal Reserve can simply create new bonds and sell them. It can do this electronically and then simply track the new bonds on their balance sheet.

Based on Federal Reserve action, interest rates on government bonds has fallen significantly. Today, the interest rates on 10-year bonds is just .88% (source: www.bloomberg.com). Three-month treasury bills are yielding just .08%.

What do interest rates have to do with Stocks? Everything!

According to Howard Marks:

“One of the biggest financial stories of 2020 is the powerful market rally that began in late March and quickly caused the equity indices to regain the ground they had lost and in some cases reach new highs. And the more I think about it, the more credit I attribute to the low level of interest rates.”

Howard goes on to explain the mechanism that caused low rates to drive stocks higher. He also talks about what we can expect for future return.

‘First, there is a stimulative affect of low interest rates’

When interest rates fall it makes borrowing money cheaper and creates incentives to spend. Howard used the example of housing and automobiles. When interest rates fall, monthly payments to buy a house or a car go down. This creates incentive for people to go out and spend more money.

In fact, I previously talked about how amazing the recover has been in home and auto sales. Home prices are on the rise, demand is very strong right now. Corporations are in a similar position. When it is cheap to borrow money, it makes it easier to invest in new product plants or improvement projects.

‘Second, lower rates increase the discounted present value of future cash flows’

This second point pushes us more into the theoretical space. To set the value of an investment, we want to know what it is worth in today’s dollars. Future returns are ‘discounted’ because a return in the future is worth less then getting the same amount today.

Think about a bank deposit. When you put your money in the bank, you expect to earn interest as the bank has use of your money. You expect that they will pay you more in one year since they have use of your money.

When we value something based on using future cash flow, the interest rate controls the value that we set in today’s dollars. If interest rates fall, the value of future payments goes up, ‘in today’s dollars’. As Howard states, ‘Thus low interest rates raise the DCF value of all investments.’

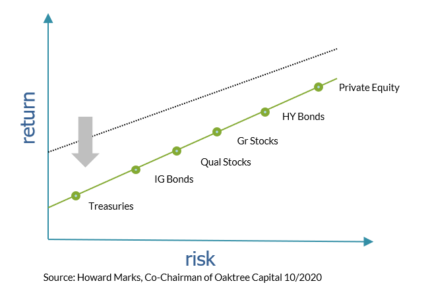

‘Third, a low risk-free rate brings down demanded returns all along the capital market line.’

Whoa… now we are getting deep into it. What is a ‘capital market line’? It’s a complicated sounding phrase we use in investment theory, but in reality it’s pretty easy to understand.

The basic idea with a capital market line is that we have a choice of different investments. Some investments are low risk. Investments like government bonds are considered ‘risk free’. Of course, the ‘risk free’ assumption means people believe the government will always be able to pay their debts. That’s a story for another day.

Other investments are riskier. For example, a corporate bond is only as good as the company issuing the bond. Companies do fail, and when they do the bond holders sometimes lose their money. Stocks are even riskier. Companies must pay off bond holder before the stock holders, so bond holders are more likely to get paid back.

In any case, theory in investing says, rational investors demand more return for higher risk. So, if we plot the various investments with both their risk and return, we come up with the capital market line!

The Federal Reserve lowered interest rate. That is the first point on the capital market line. The point Howard is making here is that the capital market line is linked. He is asserting that cutting the interest rate or return on low-risk bond, means that investors will now be willing to accept lower rates for other assets as well.

According to Marks, ‘Thus, assets and asset classes are inherently interconnected. Money moves from one asset class to the next in search of the best bargains, which get bought up until they’re at equilibrium with everything else. Changing the risk-free rate has the potential to reset the returns on everything.’

‘Fourth, lower demanded returns lead directly to higher valuations.’

Now we get to fourth and critical point. If lower risk asset returns are cut, people will demand less return for riskier assets. When I came out of college, interest rates on bonds were 11-12%. In that environment, I wouldn’t want to own stocks unless they were likely to generate better return then safer bonds. Now, with rates essentially zero, I am willing to accept lower returns for stocks because the safer alternative is much lower.

What is the effect of this? The price for riskier assets goes up and future returns we can expect go down.

It seems counter-intuitive. Here is another way of looking at it. When I buy a stock, I am ‘paying’ for the right to collect future returns. Those returns are earnings, dividends and stock price appreciate. Well, if I am willing to accept a lower return, I am willing to pay a higher price.

Conclusion

Howard Marks did a fantastic job of breaking down the mechanism where the Federal Reserve cuts interest rates leading to the stock market’s large rise in prices.

What else can explain the fact that earnings are down 30% this year and yet the market is up significantly? I believe the interest rates are the core issue. In addition to the interest rate mechanism, there are other explanations as well. The government using fiscal policy to cause more dollars to flow to consumers is also a very big element. Fiscal stimulus in the form of higher unemployment checks and forgivable loans has generated a large amount of new dollars to flow into the economy. People are saving the money, spending it on home improvements and… buying stocks.

Are we in a bubble? Bubble implies that eventually something will pop. It is true that a large increase in interest rates would cause the stock price inflation to slow or reverse. For interest rates to rise, we’d need to see some real inflation such that the Fed would be force to increase rates. With aging population, low productivity and talk of people operating online and reducing travel permanently, it is difficult to make a case of rates going up significantly. I think the ten-year rate should go back to 1.5 -2.0 gradually.

Therefore, my base case is that interest rates will be ‘lower for longer’ (credits Vanguard Group for the catchy phrase). Model portfolios will be reset using this as our foundation.