For most of 2021, Fed Chairman Powell was talking about inflation as being transitory. Now Powell is talking much tougher on inflation. During his confirmation hearing on January 11, he said the following, “As we move through this year … if things develop as expected, we’ll be normalizing policy, meaning we’re going to end our asset purchases in March, meaning we’ll be raising rates over the course of the year,” he told committee members. “At some point perhaps later this year we will start to allow the balance sheet to run off, and that’s just the road to normalizing policy.”

Regarding inflation, Chairman Powell noted, “If we see inflation persisting at high levels longer than expected, then if we have to raise interest more over time, we will,” Powell said. “We will use our tools to get inflation back.” CPI inflation for December came in at 7.1%, nearly a 40 year high.

The Federal Reserve committee expects 3 rate hikes in 2022. Of course, the $10,000 question is will we actually see three rate hikes in 2022. We have many cases in the paste when the Federal Reserve talked tough but didn’t rate rates such as in 2019. Each time the Fed has raised rate, the economy slowed at a lower discount rate.

How have stocks and bonds reacted?

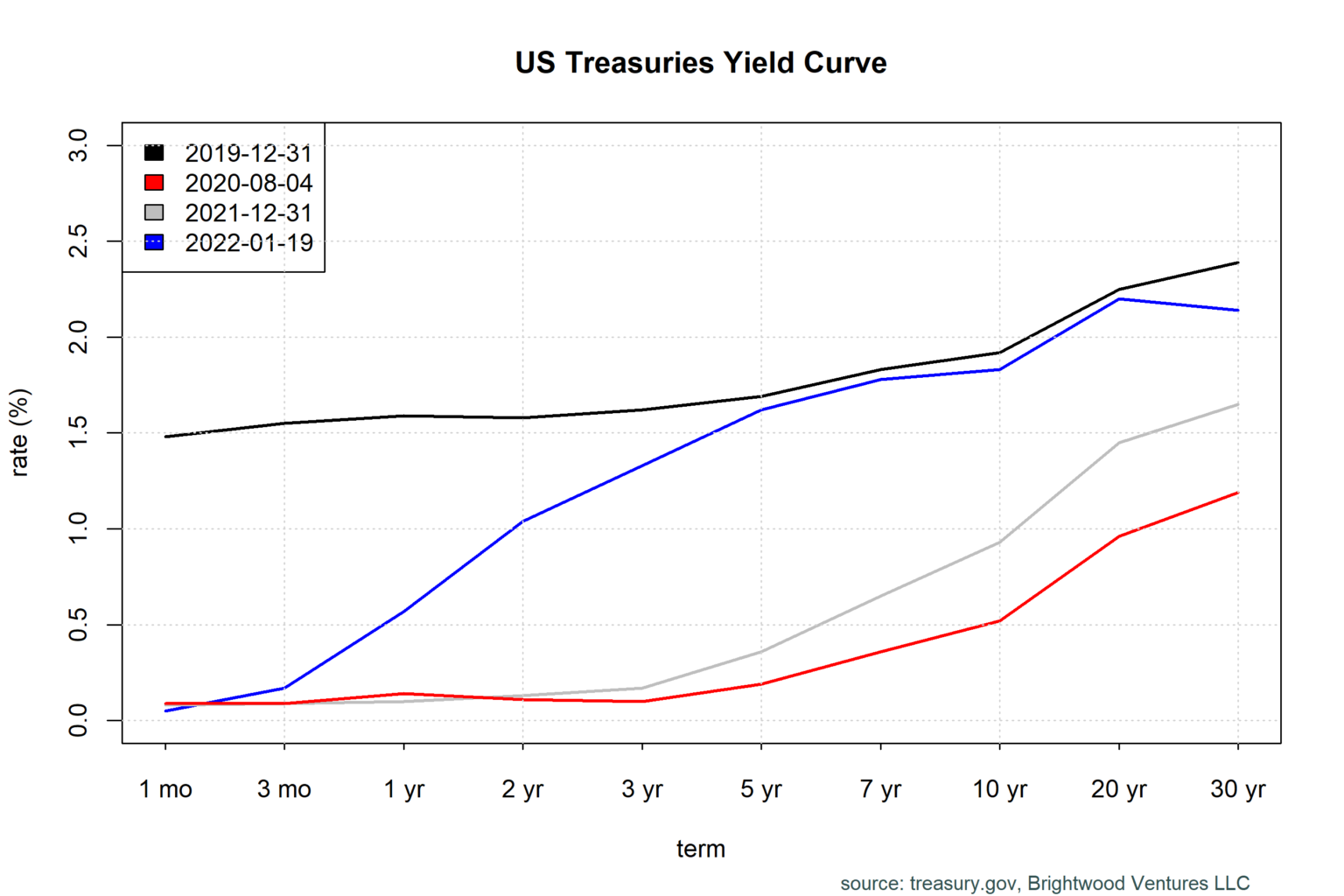

The bond is responding, with the long end of the yield curve nearly normalizing to levels from Dec of 2019 before the pandemic. In the chart below, I plotted the yield curve for Dec 2019, Aug 2020, Dec 2020 and Jan 19, 2022. First, notice that the long-term rates from 10 years to 30 years have almost entirely normalized back to the Dec 2019 level. Second, notice that most all of that normalization has occurred since the end of 2021.

Clearly, the bond markets believes we will see higher rates. The benchmark ten-year rate has moved 31 bps (.31%) just since the end of 2021. As a result, the US aggregate bond index is down 2% from the beginning of the year. US stocks are down 4.87% (S&P 500 price return). Meanwhile, high growth segments such as the QQQ are down 7.88%.

What is my outlook?

It seems the Fed has largely convinced the bond market that they will get tough on inflation. With or without the Fed, supply-demand imbalances and negative fiscal drag (lower government spending in 2022) would have largely solved the inflation issue. The long end of the bond yield curve has almost entirely returned to pre-pandemic levels. The Fed may not actually have to raise rates 3 times this year. Given the market panic in late 2018 when the Fed raised rates only to reverse in 2019, I think it isn’t probable that they will not raise three times in 2022. By simply talking tough on inflation, the Fed may have convinced the market that inflation will should be behind us.

In the meantime, we are still positioned with shorter duration in our fixed income assets along with a bias toward value and quality in our equity holdings. This fiscal and monetary reaction to the pandemic were unprecedented. The path to normalization has started.