Yesterday, President-elect Biden’s “rescue plan” for additional stimulus was released. The plan includes $2,000 in direct payments to individuals, aid for small businesses, $350 Billion in state and local aid and tax breaks and credits for low- and middle- income families.

As I review forecasts for future returns, many questions come up about whether stimulus and money supply expansion will create inflation. There seems to be nearly universal consensus that massive stimulus was required to deal with the economic disruption of the pandemic and the associated shut-down of businesses. At the same time, there is a growing group of economists who are raising concerns about unintended consequences of such unprecedented direct transfer payments. Let’s focus on inflation.

What is the outlook for inflation?

The first two economists I look to are Ed Hyman, Chairman of Evercore ISI, and Dr. Ed Yardeni. On a recent panel discussion presented by DoubleLine Funds, Ed Hyman suggested that the chance of inflation is low because we would need to see wage inflation before we’d expect to see price inflation. He did hedge a bit by saying ‘there is an outside chance’ we could get inflation.

In the same panel discussion, David Rosenberg, President and Chief Economist at Rosenburg Research and Associated, was asked about the M2 money supply and inflation. He said that we really can’t talk about inflation just looking at the M2, we have to understand what is happening with the velocity of money. We won’t get into the concept of velocity of money, other then to say it is the speed at which the money is circulating in the economy. Japan is an interesting case example. Japan’s money supply growth since the mid- nineties, when their economy and stock market crashed, has been significant. However, Japan has not been able to generate any meaningful inflation.

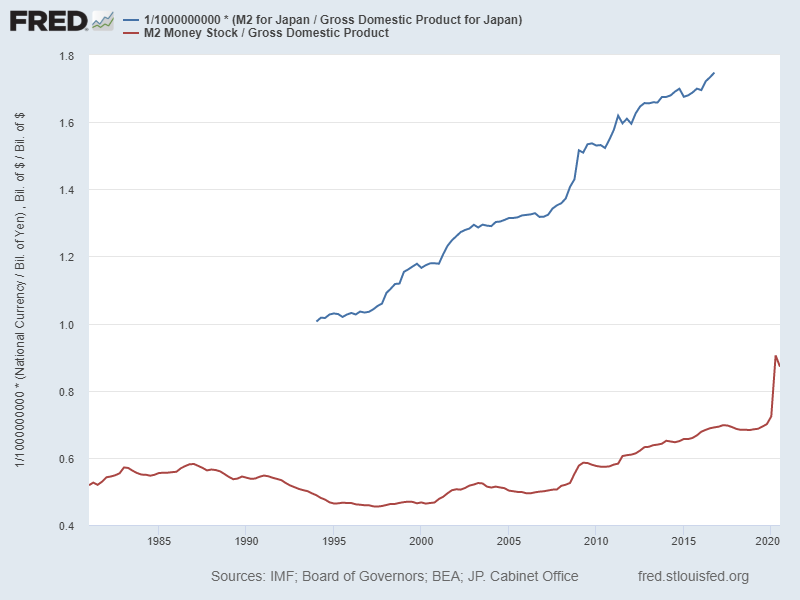

In the graph below, I plot the money supply M2 as a percentage of the GDP for the US and Japan. The US stimulus has caused the M2 money supply to jump dramatically. The money in circulation is now nearly as large as the entire economy. The parallels to Japan starting in the mid 90’s is pretty clear. Since the mid-nineties the Japanese have been expanding the money supply at a rapid pace.

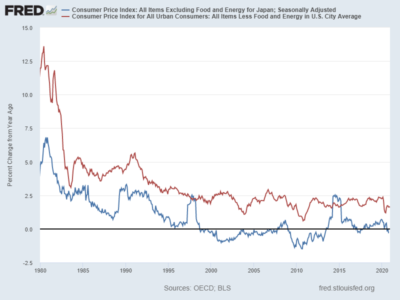

In the next chart, we see the inflation rate in Japan and the US. We can see for decades the Japanese inflation rates have been very close to zero. Even after all of the expansion in the money supply and other fiscal stimulus, the Japanese have not been able to generate inflation.

Yardeni’s 4 D’s of Inflation

In a recent blog post by Dr Ed Yardeni, titled ‘‘Inflation Was Sooo 1970s! Will It Roar Back in the 2020s?”, Dr Ed discussed his inflation outlook. He talked about his 4 D’s of inflation and concluded the discussion this way, “Our money is on the 4Ds. They should continue to keep a lid on inflation.”

For a detailed discussion of Dr Ed’s 4 D’s, see an excerpt from his recent book found here. In short, here are the ‘D’s’

- Détente. Yardeni argues that most of the bouts of severe inflation can be found when countries are in or just ending a war. In periods of Détente, freer trade between countries helps to limit prices.

- Disruption. Yardeni argues that technology and other disruptive forces help to drive productivity up and create downward pressure on prices.

- Demographics. The world’s population is aging. As people get older they spend less. This creates downward pressure on demand and tends to keep pricing pressure down.

- Debt. This one is interesting. Government debt is on the rise as governments spend more on social programs. To this we can add central bank policy that is keeping interest rates low. With easy access to credit, we end up in a situation with many ‘Zombie’ companies. These companies are called zombie’s because they just won’t die. They may be losing money, but they can borrow more and stay in business. This creates excess capacity for goods and generates a downward pressure on prices.

CONCLUSION

Vanguard Group recently updated their capital market expectations. In discussing inflation, their outlook was for a short-term bump to inflation as the economy reopens. Last year, inflation bottomed out around 1% as the economy shut down. Their outlook is that inflation would rise up to 2% this year. JP Morgan Asset Management team is forecasting 1.8% steady state over the next ten years.

Jeff Gundlach from DoubleLine on his ‘Just Markets’ webcast this week said that their company has a pretty good model for inflation and they see it hitting 2.5% by mid-year. Interestingly, he said long term he doesn’t know if we will get inflation or even deflation. There are arguments to be made on each side.

All things being equal, I would give the weight of the argument to the economists Yardeni, Hyman and Rosenburg. They make a pretty compelling case that we should not see a long-term jump in inflation. That said, the US government added 20% to personal income in 2020 with transfer payments. Assuming Biden’s $1.9T package goes through, we are in an entirely new place for the US. This amount of stimulus has no real equivalent historically. So, looking to history as a guide may not be enough.

I think we will get 2-2.5% inflation some time this year. The ten-year treasury rates will creep up as people see the inflation tic up. Dollar weakness is likely to continue especially if the government keeps increasing our debt. Foreign investors are starting to grow cautious on the dollar and I think for very good reasons.