The Labor Department reported second quarter nonfarm business labor productivity on August 9th. Productivity declined at an annual rate of .5%. On a quarter over quarter basis, productivity was down .4%. This is the first negative report in 3 years.

As a refresher, US Labor Productivity measures the amount of real gross domestic product (GDP) produced by one hour of labor. In Q2, output increased at an annual rate of 1.2%, but the number of labor hours worked grew at a rate of 1.8% resulting in lower productivity.

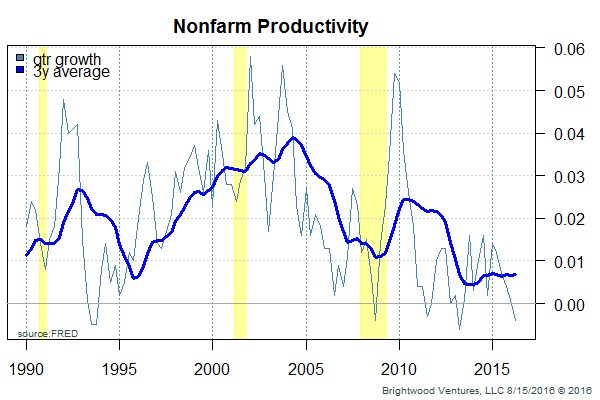

The chart below shows growth from one quarter over the same quarter for the prior year (marked ‘qtr growth’). Looking at a longer term picture, we average the quarter over quarter growth for three years. The dark blue line is a 3 year average to smooth quarterly fluctuations. The yellow highlights denote US economic recessions.

Labor productivity drives a higher standard of living. As productivity increases more goods and services are produced for the same relative amount of work. Workers are able to afford more goods.

The linkage with GDP growth and stock market returns is not quite as clear. Generally, GDP growth and productivity improvements are thought to move together and declines in productivity commonly, but not always proceed recessions and large market declines.

Implications for Investors

Over the long run, the stock market is strongly related to earnings and GDP growth. As a result, these macro indicators help provide context for investment decisions. That said, quarterly fluctuations and issues with indicator measures need to be factored in. In short, US Productivity figures give us information that informs a more complete mosaic.

What is causing the weak productivity?

Many economists are puzzled by the drop in productivity. There many theories.

One of the more hopeful theories is that the problem is how economist measure productivity. The US economy is very diverse. Loosely speaking, we have the manufacturing and services sectors. The services sector is growing at a faster rate than manufacturing. Measuring the economic output of services could be one source of error. For example, how do we measure the output of a hospital? As another example, we have moved into an era of phone and pc applications that are often given away for free. Should those be accounted for differently?

Growth in productivity is driven by investment and saving in capital, new technology and human capital. Investment and saving capital is growing at a slower rate. With less capital workers are less productive. According to Alan Blinder, former vice chairman of the Federal Reserve, ‘if we date the productivity slowdown from 2005, weak investment accounts for only about 25% of the slowdown’. (source: ‘The Mystery of Declining Productivity’, Wall Street Journal)

Another argument made by economist Dr. Ed Yardeni is that productivity in the services sector continues to lag productivity in manufacturing as the manufacturing sector is much easier to automate. Yardeni argues that, ‘the lackluster pace in productivity may simply reflect that most service industries still rely on workers more than automation to deliver services’. (source: ‘Productivity Puzzle’, http://blog.yardeni.com/)

Another interesting argument made by Yardeni is that we may be experiencing a demand problem. We can have a factory producing widgets that is highly automated, but if there is no demand for the widgets productivity measures suffer.

Another cause may be productivity declines resulting from experienced workers retiring and possibly the distraction of workers caused by multitasking and constantly checking in facebook accounts. The concerns are real. I recall an encounter with an employee in my department who was overdue on an assignment. When I stopped by his office and saw a baseball game streaming over the internet I figured that couldn’t be helping his productivity and I wasn’t shy about explaining my concern.

Leaving the measurement and technical issues aside, I wonder about long term innovation. My experience has been primarily associated with the technology element of productivity. Reflecting on the state of technology change in just the last 30 – 40 years, we started with main frame computers and punch cards. Personal computers took off. Networks connected computers in the office and we went mobile with wireless phones. The amount of automation and productivity gains coming from computing, the internet and wireless networks is staggering. What will be the next driver for huge increase in productivity? If the history of the United State repeats itself, whatever it is, it will be spectacular.