, cc2.0)

For the first time since 2009, it looks as though foreign stocks will beat the S&P500. The MSCI ACWI Index ex US is up 23.42% through November compared with the S&P 500 Index at 20.49. It is a good time to reexamine international investing and it’s place in your portfolio.

Let me start with a quote from Jack Bogle, Founder of the Vanguard Group (1994),

‘It has become popular in financial circles to speak of investors owning the “entire world market.” The implied added diversification would justify a commitment of 57% of equities to non-U.S. stocks, since they comprised 57% of the world’s total market capitalization at the end of 1992. The remaining 43% would comprise U.S. stocks. I do not believe such a posture makes sense. Given the incremental currency risk, not to mention the addition of sovereign risk (the risk that a nation will default on its financial obligations and the risk of political instability or even war), your exposure to mutual funds investing in foreign stocks should not exceed 20% of your equity portfolio’ – Jack C. Bogle (1994)

It is worth noting that since 1994, Bogle has softened his stance somewhat. In recent comments made at Morningstar’s Investor Conference in October, he said “I wrote that as far back as 1993, when I was thinking about currency risk, and financial and institutional risks in other countries. I do think investors can make a legitimate choice if they want to do non-U.S., they should do it.”

In this article I would like to walk through arguments in favor of US investing vs. foreign investing.

In Favor of US Investing: Foreign Stocks Have Currency Risk

Foreign stocks typically are held in mutual funds, and exchange traded funds are denominated in the local currency. Toyota, for example, is held in Japanese Yen. If the Yen currency falls relative to the US, our returns for owning Toyota based on dollars goes down. Currency risk is large in emerging market countries relative to large countries but not immune. In 1998, Russia defaulted on their loans and the government substantially devalued rubbles. It is possible to mitigate currency risk by hedging, but this comes at a cost to investors.

Another way I like to look at currency risk is to think about the US investor. We are saving and investing for our future retirement. All of our obligations in the future are in terms of dollars. We buy food, gas, goods in US dollars, not foreign currency. So, for a US investor, taking on currency risk is not just some academic concept. If we invest in foreign stocks and the dollar goes up in value, our portfolio return in dollars takes a hit.

In Favor of US Investing: Historical Returns for US Stocks Has Been Greater than Foreign Stock Returns.

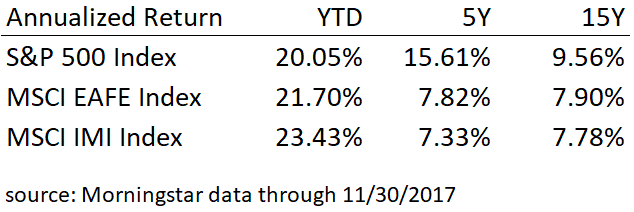

Since Bogle’s comments in 1994, the US market has generated substantially better returns then foreign markets with lower risk. The table below summarizes the US total return, International Developed Country Returns and Emerging Market returns. Over the last five years, the S&P500 has beaten developed country international stocks by greater than 7.5%.

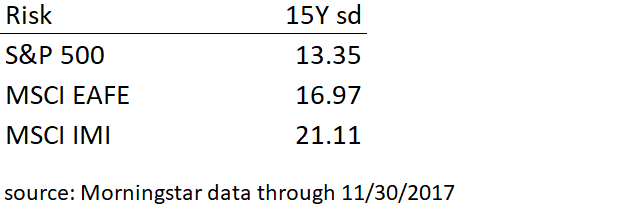

Risk for international stocks is higher than US stocks. Measuring monthly return standard deviation, Developed Country international stocks are 27% more volatile. Emerging market stocks are 60% more volatile.

In Favor of US Investing: Sovereign / Political Risks

Bogle noted sovereign risk defined to include government default, political instability or war. These risks are hard to quantify, but arguable these risk are greater in emerging markets then developed markets. Historical risk of the markets seems to be a good indicator of underlying sovereign stability.

In Favor of US Investing: Business Environment

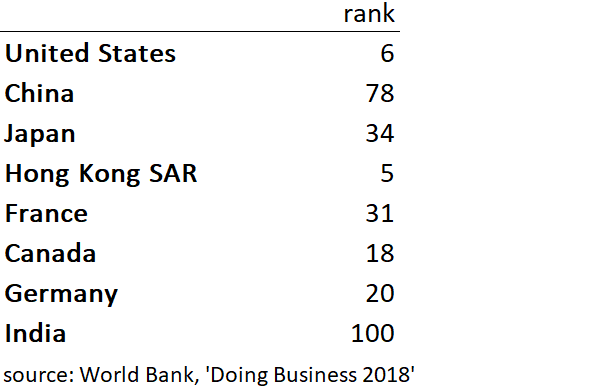

There are a number of factors which impact how business friendly a country is. These include measures such as degree of regulation, the strength of property rights, infrastructure (transportation, utilities, etc.) and the legal environment (including such things as contract law and dispute resolution). Living in the US, but having done business in outside countries, I have seen how big the differences can be between the US and foreign countries.

The World Bank produces an annual report that ranks factors noted above. The following table summarizes the ranking of the countries with the top stock market capitalization countries. The United States has consistently ranked near the top of all as being favorable to businesses.

In Favor of US Investing: US Companies Derive 40% of Their Revenue From Foreign Countries

One of the arguments for international investing is diversification. However, as the world becomes more globalized, companies expand internationally and generate revenue abroad. According to S&P Dow Jones, in 2016 43% of revenues generated by the S&P500 companies came from international. One could argue that in large part you can participate on the global economy simply by holding US large cap stocks.

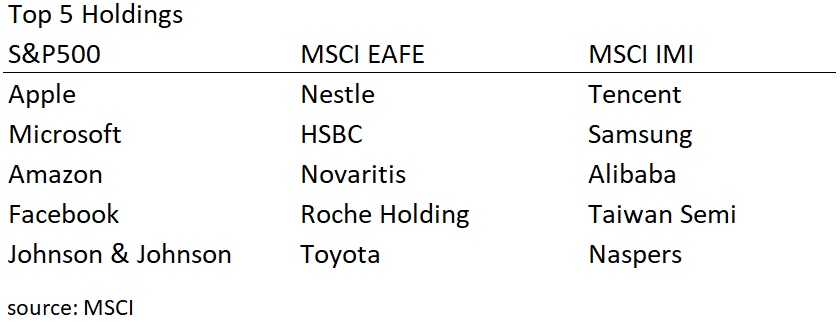

The next table shows the top five companies by market capitalization in the US S&P 500, developed country and emerging market country indices from MSCI.

Apple generates greater than 60% of its revenues overseas. Most all of the companies on this list, other than some found in the emerging market index such as Tencent (Chinese social media), Alibaba (Chinese e-commerce) and Naspers (South African listed company in digital broadcast, media and e-commerce), are recognizable given their global footprint.

Let us now turn our attention to argument in favor of holding international stocks.

In Favor of Foreign Investing: Growth

Some argue foreign stocks should be included in US portfolios because foreign countries GDP growth may be higher than the US. Let’s break this down. First, developed countries outside the US are currently growing at a slower rate than the US. UK, Germany and France are top countries represented in the MSCI EAFE index. It is also interesting to note that the percentage of technology and healthcare stocks in the EAFE index are well below that of the US S&P 500.

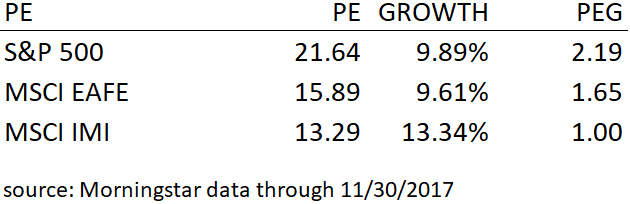

Emerging Market companies are expected to produce higher growth than the US. Based on current estimates for earning growth for the companies found in the MSCI Emerging Market Investable Market Index (MSCI IMI), long term earnings growth is expected to be 13.34%, roughly 3.5% faster than the US.

I think it is important to point out that growth does not ensure investment return. We have to consider the risk associated with those returns and the current valuation for the stocks held. Generally, theory holds that the higher the expected risk of an asset class, the higher our required return should be. As such, we should demand higher return for emerging market stocks presuming they will continue to be riskier than US stocks.

In Favor of Foreign Investing: Higher Return (due to mis-pricing).

It may be possible that stocks in one country vs. another are not fairly valued. From the table above, we might look at the measure ‘PEG’. This is a measure of the PE ratio divided by the growth. For each 1% gain in US earnings, we are paying 2.19x according to the PEG. Developed international stocks are trading at PEG 1.65 and emerging market stocks 1.0.

Using a simple valuation model we might estimate the market implied required return given the current PE and earnings growth. Let’s make a grossly simplified assumption that stock market returns will be half of the projected long term earnings growth from the table. In that case, given the current PE that stocks are trading at, the implied required return for US is 9.8% vs. 11.4 % for developed international and 14.5% for emerging market.

In Favor of Foreign Investing: Diversification

Some have argued for holding international based on diversification. Over time, diversification for US stocks and international stocks has declined. Depending on the time period, correlation between US and non-US stocks is somewhere in the .7 to .8 range. Also, it is important to note in periods of severe stress like the financial crisis of ’08 – ’09 the international and US stocks moved down together. At the point where diversification is needed most, it may not be there. In today’s environment, I find this to be one of the least compelling arguments.

Conclusions

On balance, I believe the arguments favoring a US-centric investment posture as the base case make the most sense. We are looking to generate returns in US dollars. We don’t want to take unnecessary currency risk if we don’t have too. Now, that said, I believe that there can be a case for international investing if relative value analysis shows that foreign stocks are undervalued. Given currency and sovereign risk and historically large volatility I’d like to see a potential for at least 1-2% excess return in developed markets and 3-4% in emerging markets. Over the long run, an 80/20% allocation to US vs. international may be called our base case (also called the ‘policy portfolio’ by institutional investors).

Given the recent rise in US PE ratios, the relative PE ratio for international and emerging markets has widened. In part II of this article I will talk about the relative value of international and emerging markets and tactical updates we will be making in 2018

References

Bogle, J. C. 1994. Bogle on Mutual Funds: New Perspectives for the Intelligent Investor. Burr Ridge, IL: Irwin.