- Portfolio rebalancing is the process of aligning your portfolio allocation weights back to a defined model asset allocation.

- The objective is to keep your portfolio close to a target risk-return profile. Over time, differences in returns by asset class will change the risk profile. For example, over the long run stocks will tend to outperform bonds and the allocation percentage to risky stocks increases.

- In this post I will explore the results of a paper published by Vanguard entitled, “Best Practices for Portfolio Rebalancing”, Yan Zilbering; Colleen M. Jaconetti, CPA, CFP®; Francis M. Kinniry Jr., CFA. Vanguard Research. 2015.

Introduction

For this discussion, we will use the illustrative example noted in the Vanguard paper. Namely, consider an investor who has set an asset allocation model of 50% stocks and 50% bonds. For many investors, the process of rebalancing can be uncomfortable. When the stock market rose to great heights in ’08, many investors abandoned their models and added to their stock positions at the wrong time. Conversely, when the market crashed, many sold. Allocation to equities in the US dropped from 65% before the crash to 35% after the crash. After the crash, when valuations were low, was a good point to rebalance back up to targets. Behavioral finance shows us that typical investors don’t always make the right choices when faced with volatility. What is an investor to do? The best practice starts with selecting a systematic way of rebalancing and then sticking with it.

Rebalancing Options

The authors of the paper explored several different strategies for rebalancing, including:

- No Rebalancing. Portfolio initial weights are set and never rebalanced.

- ‘Time-only’. Rebalancing on a periodic basis (monthly, quarterly, annually). In this method, the portfolio is rebalanced back to model weight even if the current allocations are off by just a small amount.

- ‘Time and Threshold’. Rebalancing occurs at a set time boundary and only if the allocation weights deviate by greater than a defined threshold such as 5%.

Trade-offs

We have discussed the benefit of rebalancing: to bring the model portfolio in line with model allocations. Rebalancing comes at a cost. Costs include: time to execute trades, commissions to execute the trades, bid-ask spread for stocks and ETFs, and tax impacts. For these reasons, it should be clear that excessive rebalancing may cost more than any benefit provided. For example, take a small portfolio where we have a deviation from the model of just $500. Cost to trade is $6.95 and assume we have bid-ask spread impact of $500 * .002% = $1. Excluding the time required to make the trade, the total costs of $7.95/$500 is 1.58% of the $500. Clearly, we need to consider the frequency of the rebalancing and how far we are deviating from the model.

Results

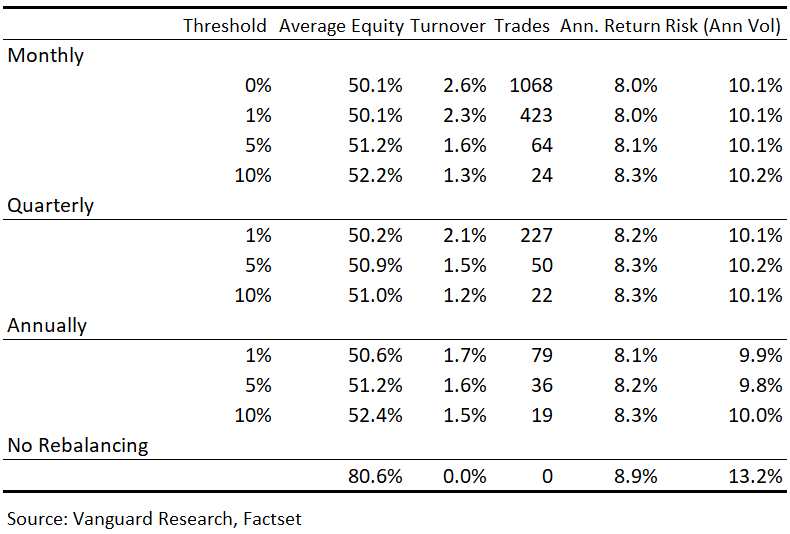

The Vanguard authors ran thousands of simulations and generated results for many scenarios. To save time, I will summarize the ‘Time and Threshold’ vs ‘Never Rebalance’.

Vanguard’s experiment went from 1926 – 2014. They assumed all dividends and bond interest were reinvested. Costs were not explicitly computed. Instead, Vanguard captured the amount of portfolio turnover and the number of events (or trades).

From the table above, we can see that setting the threshold for rebalancing too low and/or rebalancing too frequently can result in a large amount of portfolio trades and turnover. In addition, most all of the risk reduction can be achieved even with an annual rebalancing method when thresholds are in the 5-10% range. There is no material difference between risk and return by increasing the frequency or reducing the threshold. In this example, there is little to be gained from frequent rebalancing.

Note also that tax consequences are not directly computed. In addition, we know that the after-tax risk of the portfolio should be lower. The details go beyond the scope of this paper. Given these two qualitative points, the conclusion would tend to suggest a longer rebalance checkpoint and/or larger threshold.

Implications for Investors and Clients

According to Vanguard, “we conclude that a rebalancing strategy based on reasonable monitoring frequencies (such as annual or semiannual) and reasonable allocation thresholds (variations of 5% or so) is likely to provide sufficient risk control relative to the target asset allocation for most portfolios with broadly diversified stock and bond holdings.”

For portfolios in taxable accounts with multiple asset classes the rebalancing exercise is a bit more complex. In cases where large capital gains that cannot be offset with losses (tax loss harvesting), deviation from the 5% rule may be appropriate. Also, when we have multiple funds covering a larger set of asset classes, deviation from thresholds for a particular fund or asset class may be reasonable if the overall risk-return portfolio does not deviate substantially. For example, an international developed market stock fund has similar risk to US stocks. If total equity risk is in line, we would not be as concerned about excess allocation to the sub-asset class of international developed market stocks. In addition, it can be a good idea to control costs by setting a minimum dollar amount for rebalancing. As a general rule of thumb, I’d like to keep commissions and bid-ask spread costs to something below 40 bps (.4%).

Brightwood Ventures uses both custom in-house developed software and software provided by TD Ameritrade to help optimize the rebalancing process. Feel free to call us if you have additional questions.