The ^VIX (also known as the fear gauge) is up over 15 today at 17.42. Tension with China over the trade negotiations continues to dominate financial news. I think the dispute could last for some time and there is no question that increased tariffs could impact equity returns. Year to date the market is up 14.86%, but for the month down 1.59%.

When short term noise goes up, I always like to zoom out and look at the big picture. So let’s look at an update on the Real Earnings Yield (REY) for the stock market. As I’ve said before, REY is my favorite valuation estimate for US stocks. Detailed discussion of REY can be found here.

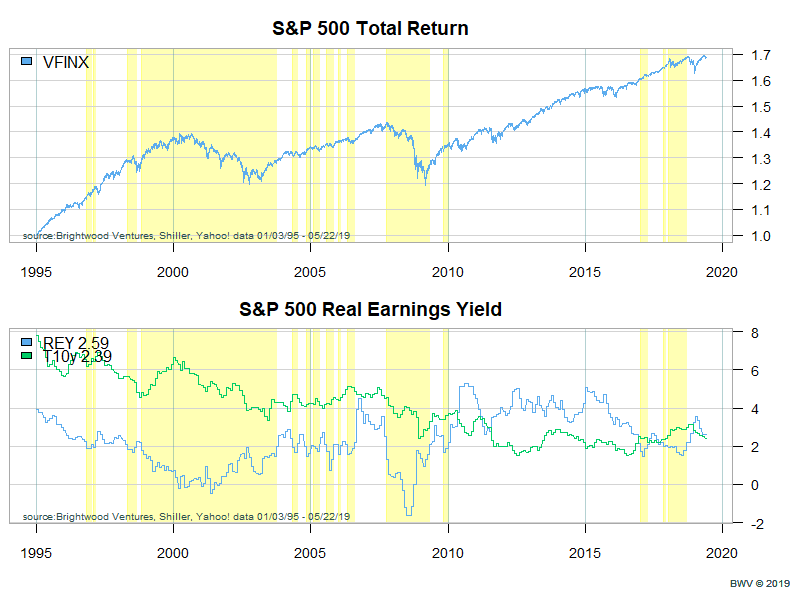

The long term average for REY is 2.5%. Currently, the S&P 500 earnings yield is 2.59%. So, under the assumption of zero growth, the earnings return for owning equities is 2.59% above CPI inflation. All things being equal, this puts us in the middle of long-term valuation on this measure. At this point, earnings results have been reasonably good and I expect for the year, growth will come in at about 5%.

In the chart above, the S&P 500 panel shows total return on a long scale. In the second panel, the green line is the yield on ten year treasury bonds. The blue line is the real earnings yield. In both panels, the yellow highlighted region represents the periods where the real earnings yield for the S&P 500 was below 2%.

It is possible for the continuing trade dispute to impact earnings. Volatility may continue. In fact, I expect that the current trade dispute will not get dramatically better or worse for some time. I expect the tit for tat tariffs will continue. I do think there is some impact on the economy, but I don’t think so much so that we go into GDP decline. I believe the US economy is stronger and more durable than many think. I continue to like our neutral weight toward equities (meaning we are not over- or under- weighted compared to our five model portfolios).