The interest rate yield curve continues to flatten. US stock prices continue to melt up. PE ratios have stretched into mildly overvalued territory. We remain neutral weighted on the US stock market and may adjust tactical allocations down if the PE ratio stretches much further.

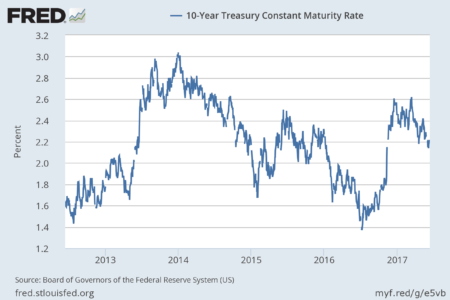

Interest Rates

The Federal Reserve, as expected, hiked the Fed Funds rate by .25% today to a target of 1 – 1.25%. The bond market reaction was to continue the trend toward flattening. Two year treasuries are 1.34%, up 62 bps in the last year. Ten year treasuries are 2.13%, up 52 bps. Thirty year treasuries are 2.77%, up 36 bps. (source: Bloomberg). The Fed statement acknowledges that inflation is running below their 2% target, that the economy will ‘expand at a moderate pace’ and that job gains have been ‘solid’.

Earlier this year, I summarized market outlook comments from Jeff Gundlach of Doubleline here. He predicted that we could see 3% for the 10Y this year and that would signal the end to the bull market. The bond market isn’t buying it. The market has tested 2.6% several times since the election, only to fall back down. We continue to watch the 2.6% level as a key test going forward.

The Dollar

At the time of the presidential election, EUR-USD stood at approximately 1.12. The dollar rallied into the end of 2016, and the EUR-USD was 1.05. The dollar has since weakened and today stands at 1.12. Déjà vu, that strange feeling that we have been here before.

US Equity Earnings

Q1 earnings per share for the S&P 500 companies were up 14.5% year over year, the best growth since 2011. (Source: Thomson IBES). Revenue per share was up 6.9%. For the year, Standard and Poor’s is reporting consensus estimates of $128.25. For 2018, the consensus estimate is $145.65. (Source S&P Indices, 6-08-2017 data). Forward earnings estimates are continuously revised down. Dr. Ed Yardeni is forecasting $136.75 for the S&P 500 for 2018. This amounts to a 5% growth in earnings. If tax reform is passed in the US, he believes earnings would be $150 for 2018. (Source: http://blog.yardeni.com/ may 31, 2017).

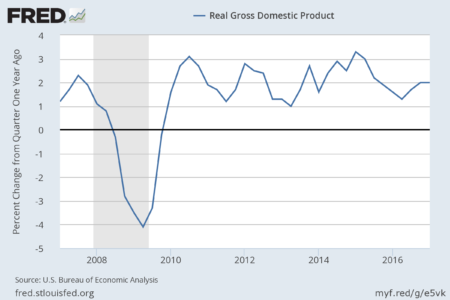

GDP Growth

The Atlanta Fed GDP Now was updated today with a forecast of 3.2%. This is above the recent trend around 2%. The 3.2% instantaneous forecast is nice to see, but given demographic headwinds, low productivity growth and apparent delays in tax reform I’m solidly in the camp of ‘Show Me’ that we can hit this for multiple quarters running before I would put much stock in it.

Market Returns and Valuation

The S&P 500 total return year to data is 10%. The MSCI international developed markets index has gained 15%. (Source: Morningstar prices through 6-13-2017). If we take Yardeni’s estimate of $136.75, the forward PE for the S&P 500 is 17.8 based on the index at today’s close of 2437.92. This is stretched by most all historical measures.

Analysis

The bond market and the dollar seem to be signaling that they don’t see much chance of major tax reform. We are essentially back to the rates we saw just before the election. The market run is harder to explain. Growth seems to be priced in, along with high consumer sentiment and some believe that reforms will pass.

Where does that leave us? Most all assets are expensive. Future returns will remain compressed. For US equities new money should be dollar cost averaged in. We are watching the 2.6% 10Y rate as a key threshold. If the S&P 500 reaches 2,558 without sustained growth in earnings and/or tax reform we would strongly consider cutting equity weighting by 5-15% for our balanced and growth model portfolios.