Jeff Gundlach, CEO of DoubleLine Capital, spoke about his views on the US economy and global markets in his Tuesday webcast “Just Markets”. I’ll highlight some of his key points. Interestingly, Gundlach was one of a very few investment professionals who predicted a Trump win. He has a pretty strong track record on his market calls. For example, he argued for going long TIPs last year at the point where inflation rate expectations were at the bottom. Since that time, the break-even inflation rate expectation has climbed from roughly 125 bps to nearly 200 bps.

Economy

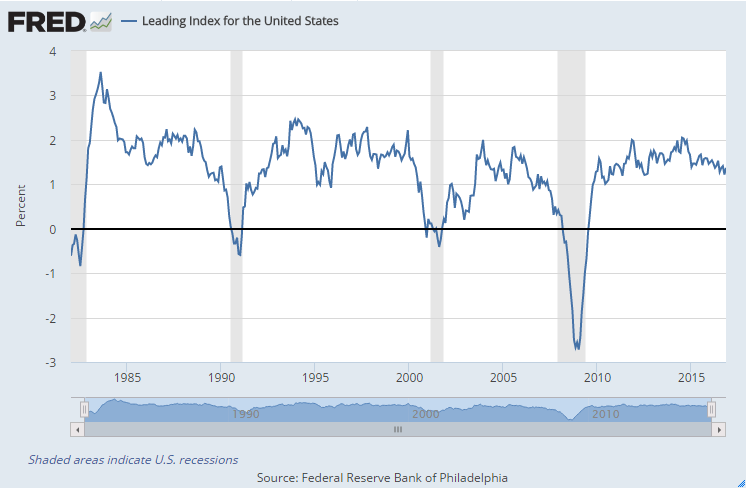

Gundlach noted that 7/8 new Presidents, when following a two-term President have faced a recession in the first 1-2 years of their presidency. However, he then went on to show a number of slides indicating that we don’t see signs of it so far. He showed the Conference Board LEI chart (I have included the Philadelphia Fed LEI data above). He went on to show CEO confidence and increasing consumer sentiment. Both are rising and took a strong bump up with the Trump election. Gundlach did comment that, ‘he was surprised with the bump, given that Hilary had the majority of the vote… but, I guess optimism is contagious…’

Interest Rates

Gundlach had a very strong conviction on bonds. He said we are in the midst of a bond rally that will eventually fade and give way to further rises in the 10Y treasury rates. He said we could see 3% by the end of 2017 and went as far as to predict 6% by ‘the next Presidential election cycle’. His view was that when we hit 3% that 1) this will signal the end of the bond bull market, and 2) that 3% would be bad for the stock market. He did say that holding bonds still makes sense in a diversified portfolio, but that active management is required given the rapidly changing environment. As a side note, we have a large position in the Pimco Income Fund. That fund was up over 8.72% in 2016, beating Gundlach’s actively managed Doubleline Core Fixed Income Fund (symbol: DBLFX) which returned 4.72% in 2016.

The Dollar

Gundlach is not bullish on the US dollar. He showed long term currency charts and suggested that we are 8 years into the dollar rally. He didn’t seem to have a strong conviction of a reversal yet. Later in the discussion he did say that he liked the Japanese stock market, but given the weak yen that any position should be currency hedged.

Macro Allocation

Gundlach felt that PE ratios in the US were quite high and that now may be a good time for investors to look at international equity diversification and commodities. He holds some gold, although he noted that he isn’t particularly bullish on it. Oil prices have risen sharply and are close to the $50 target he had previously forecast. He advocated a small position in commodities for diversification.

US Stock Market

Gundlach said the best argument for being long US stocks is the potential for tax reform. Of course, tax reform would flow through to earnings and prices would rise. Earnings forecasts for 2016 are around 20% over 2015. He felt those were too bullish, as earnings expectations always fall as the year progresses, but he was confident we will have growth over last year. As noted above, he sees risk with a rate rise over 3%, historically high PE ratios and potential for negative Trump effects.

International Stocks

Given valuation concerns, he advocated international equities in some countries. He noted that he doesn’t like Europe given political problems. He likes Japan because he feels they are starting to see some inflation and there is a constant inflow of equity purchases given sources such as government and pension plans. He showed a chart with the divergence in PE ratios between US, developed and emerging countries. He said he also likes India for a few reasons. His base premise was that India has the advantage of demographics working for it. (GDP growth is the sum of productivity growth and population/labor hour growth). He also said that they have the prospect for reform and that the market had taken a bit of a breather. He had a chart that showed that India was the only other market since the financial crisis that has kept pace with the US.

He didn’t talk much about growth in international markets. I would just note that looking at PE without considering earnings growth would be a mistake.

Wrap Up

Gundlach’s webcast covered a huge amount of ground. The interest rate path and target rates were Gundlach’s highest conviction points. Our 2017 model portfolios remain well diversified as suggested by Gundlach. We also favor emerging markets and are avoiding European equity markets. We also see managing interest rate risk is key and are further underweighting the US Aggregate Bond funds in favor of actively managed bonds.