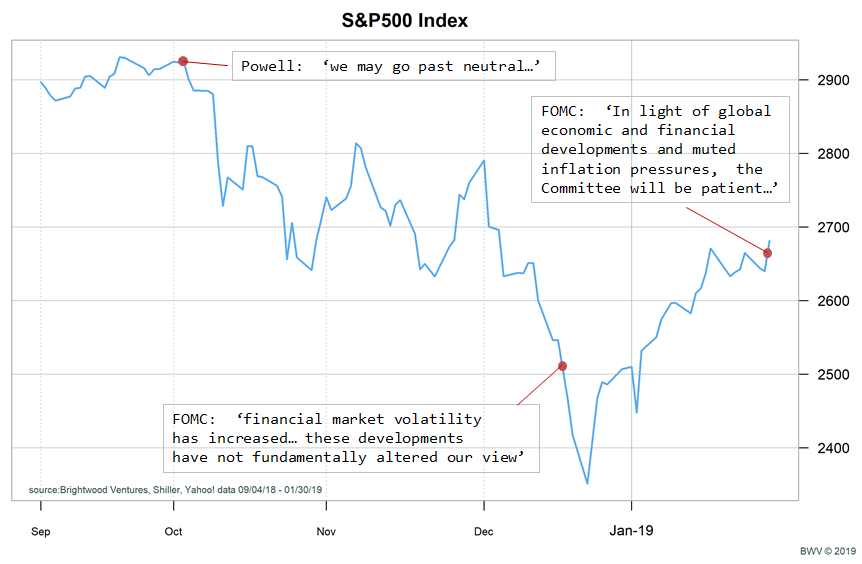

Yesterday, the Federal Reserve held the Fed funds rate at their current level, between 2.25 and 2.5%. This after hiking rates 4 times last year. The Federal Open Market Committee (FOMC) minutes state, “In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

The change in stance over the past 6 months has been dramatic. Through the middle of 2018, the FOMC had taken an aggressive stance and was signaling 3-4 hikes in 2019. According to comments by Jeff Gundlach made earlier this month, the bond market is forecasting no hikes for 2019.

On October 3rd, Fed Chairman Powell was being interviewed by PBS. He commented that the Fed, ‘may go past neutral’ on interest rates. The neutral rate is the rate at which the economy is considered to be in balance. This would be the rate at which the economy is running at or near its maximum potential without excess growth or inflation. The comments were certainly a contributor to the worst stock market quarterly performance since the depression.

On December 19, the FOMC met and provided additional guidance. They held their ground. The minutes acknowledged that the financial market had been experiencing volatility but, ‘In our view, these developments have not fundamentally altered the outlook.’ The market dropped to its low on December 24th, three days after the statement.

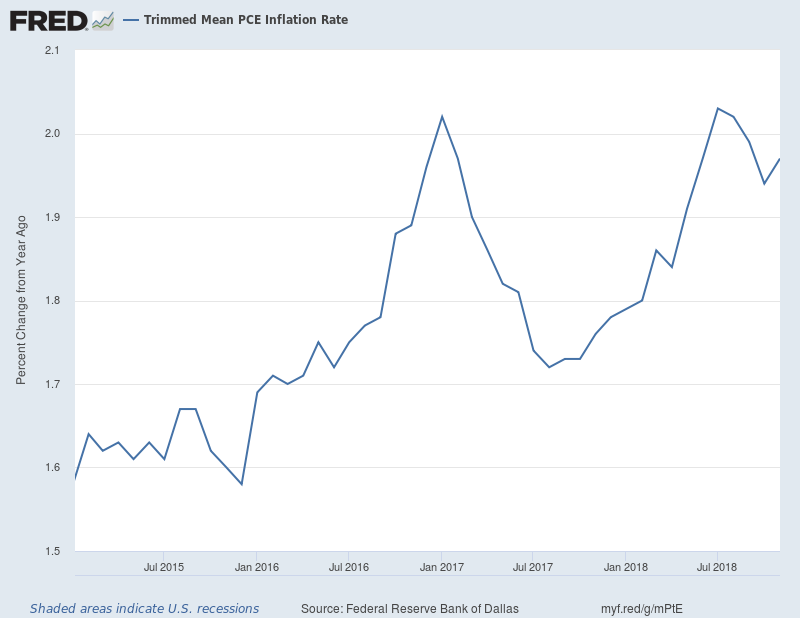

In the press conference after yesterday’s meeting, Powell’s tone was much more accommodative. He said the Fed had the ‘luxury’ of being patient. He went on to say, ‘I would want to see a need for further rate increases, and for me a big part of that would be inflation.’