We are roughly six months into the market correction for Coronavirus. Over the next three posts, I will provide a market outlook. In part 1, we will look the impact on stock earnings and returns. In part 2, we will review the current state of the economy and relative value of equity market segments. In part 3, we will look at relative value and how we will be positioned going forward.

The focus of part one will be on US equity market returns. Key points:

• The Federal Reserve predicts US real GDP for 2020 will decline -6.5% from 2019

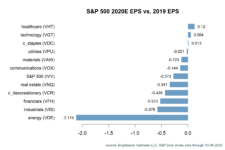

• For the S&P 500, earnings forecasts for 2020 are expected to decline 27%. This varies greatly by sector.

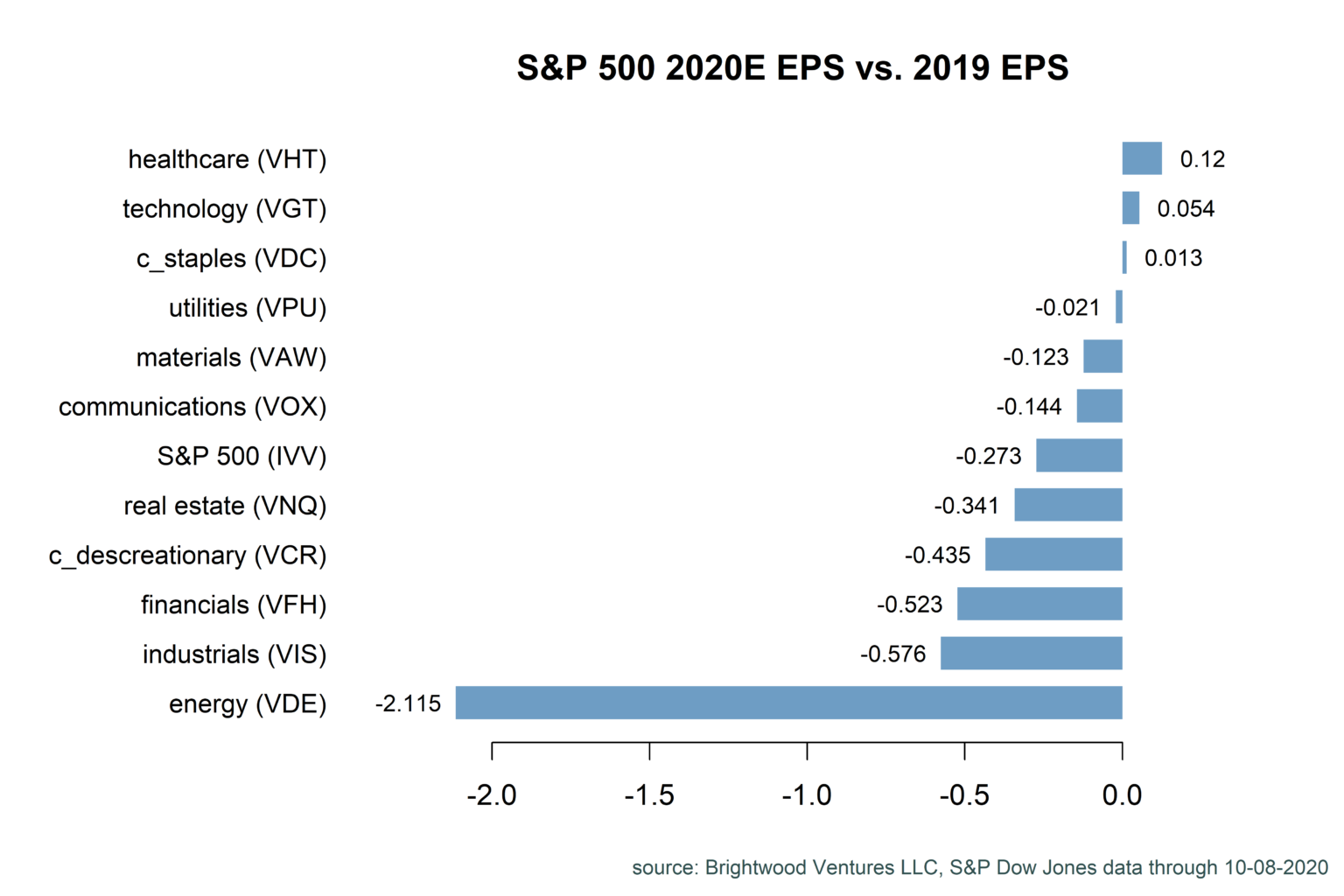

• Returns by US sector have ranged from +33.2% (technology) to – 46.8% (energy)

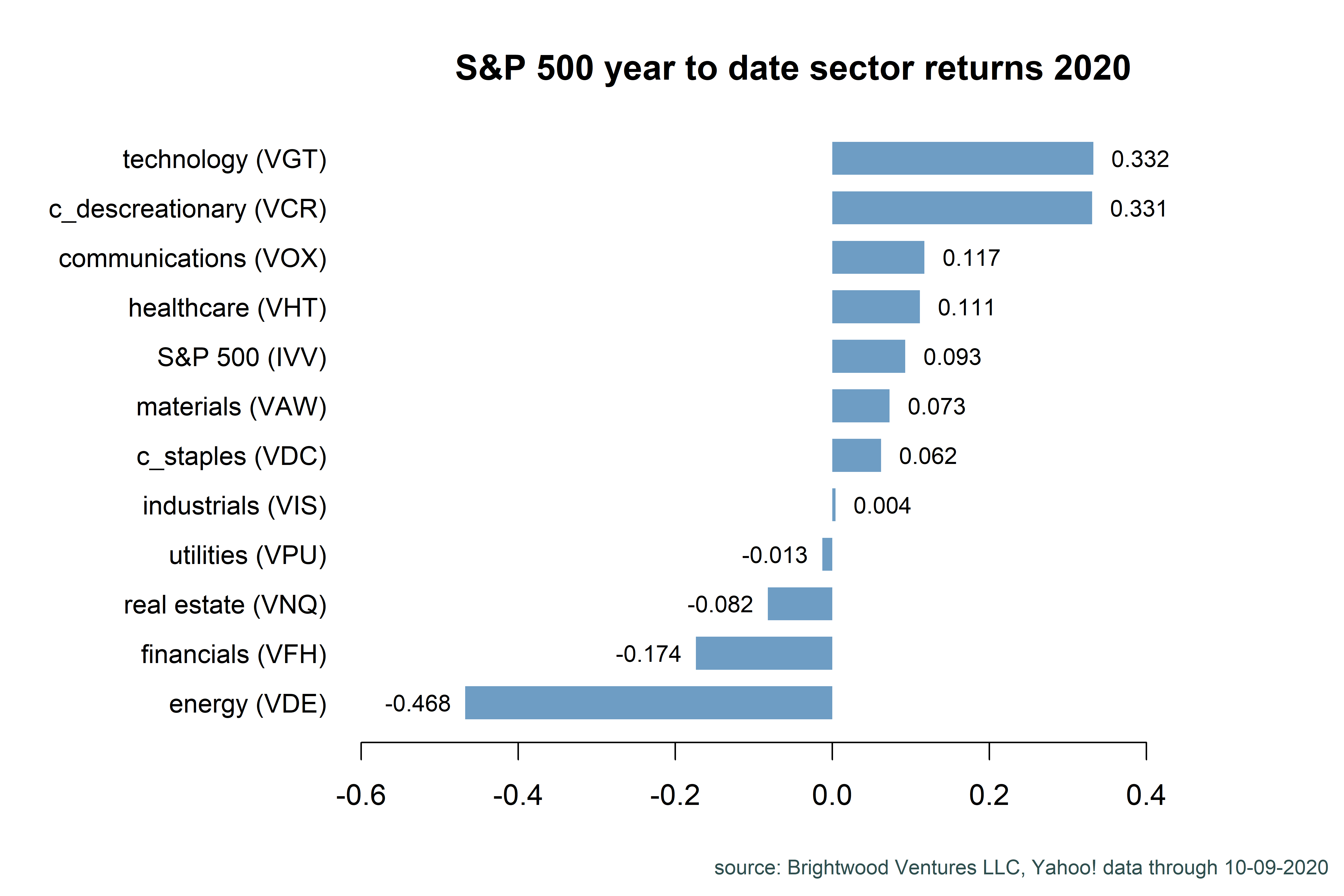

• Large cap growth (+ 30%) and momentum factor (+22%) returns have outpaced the S&P 500. Small cap stocks (-.007) and small cap value (-14.3%) have lagged the broader market.

A current snapshot of the economic situation:

| Q2 Real GDP Growth | -9.03% |

| Federal Reserve 2020 Est | -6.5% |

| Federal Reserve 2021 Est | +5 |

| Current Unemployment Rate | 7.9% (Sept data) |

| Federal Reserve 2020 Est | 9.3% |

| Federal Reserve 2020 Inflation | 1% (core PCE) |

Source: St Louis Fed, federal reserve.gov monetary policy update June.

Total US nonfarm payroll for September was 141.72 Million jobs. Peak US jobs in February were 152.463 Million. In the most recent June US Chamber of Commerce poll, almost 90% of businesses polled were open in some capacity. Services and retail businesses are the most impacted with 82% reporting that they are open in some capacity. Although there are hopeful signs for the recovery, the majority of small businesses were worried about a resurgence of the virus. Only 20% of small businesses applied for the PPP loans and of those, 67% said they were concerned about meeting the criteria for loan forgiveness. Twice as many companies (21%) are reporting they have fewer workers compared to 2019, with just 10% reporting they have more employees. 30% of small businesses expect to add staff in the next year.

S&P 500 Earnings by Sector

According to data from S&P 500 Dow Jones through October 8, earnings for S&P 500 companies will decline by 27% in 2020. The earnings decline varies dramatically across segments. Earnings are expected in increase in just three sectors: health care (+12.6%), technology (+5.4%) and consumer staples (+1.3%). Energy (-211%), industrials (-57.6%) and financials (-52.3%) have been hit the hardest.

S&P 500 Sector Returns Year to Date

For the year, through Oct 9th , the S&P 500 is up 9.3%. Again, the returns vary significantly across sectors. Technology (+ 33.2%) and consumer discretionary (+33.1%) are the clear winners. Let’s dig a bit deeper. The sector information is a convenient way to look at the top 500 US companies but within the sectors the range of returns has also been dramatic. For example, year to date the chipmaker Nvidia is up 134% while Intel is down 10%. Apple is up 60% while IBM is down 1%.

Consumer discretionary is another interesting sector. Amazon is up 126%, Home Depot is up 26%. A direct connection to change in behavior from the pandemic is pretty clear. Online shopping was a clear winner. Home improvement is an interesting category as well. Banking data showed that consumers spent their stimulus money in three ways: 1) they increased savings, 2) they spent the money on home improvement projects, and 3) they increased their stock buying and selling. Also found in the consumer discretionary segment we have Marriott. Marriot is off 34% for the year.

As we look forward to building a case for relative value of a specific company or sector, we’ll want to look at how shifts in behavior are likely to play out. Are these long-term trends? Is the growth in spending and earnings likely to sustain itself? In technology, we know there have been major purchases to facilitate remote work from home and online education. What happens when the technology upgrade wave is completed? Does growth return to ‘normal’. Clearly, the impact to specific industries has been very uneven, given the nature of the virus.

What About Fundamental Factors?

As we have discussed before, we use fundamental factor analysis in defining ‘tilts’ in the model portfolios and in selecting individual stocks. Let’s take a look at some ETF products that embody some of the popular factors.

Based on long term studies of factor-based investing, we know that returns to the factor are time varying. Also, during market correction we see patterns emerge for certain factors.

Generally, in a market decline momentum stocks tend to perform well. Value stocks and small cap stocks tend to under-perform. During the first phase of the market decline (from the high on Feb 20 through the low on March 23rd), the momentum ETF (MTUM) dropped 33.8% roughly in line with the S&P 500, but in the initial recover stage (March 23 – June 30th) rose 46% compared with the S&P 500 at 40%. Meanwhile, small cap stocks and small cap value stocks declined much more sharply than the S&P 500 (-40.8% and -43.8%, respectively). High ‘quality’ factor stocks tend to decline less in the initial correction. This was the case for technology (-27%) and health care (-28.4%).

Where Do We Go From Here?

From this brief analysis, we can see that the pandemic impact to earnings has varied across company, sector and factors. We buy stocks for the earnings and earnings growth. Ultimately, fair value estimates for a company are derived from their individual circumstances. However, using sector and factor-based models helps us to form opinions about the most likely segments where we will find relative value.

In Part 2, we will take a close look at estimated growth for 2021 based on sector and factor funds. We’ll look at a few valuation metrics and look to spot specific sectors that may be over and/or under-valued relative to their fundamentals.

https://www.uschamber.com/report/july-2020-small-business-coronavirus-impact-poll