, cc2.0)

For the ten year period ending in November, the Vanguard Information Technology fund (VGT) and Vanguard Healthcare fund (VHT) generated 11.85% and 11.30% total return, respectively. This compares with 8.3% for the S&P 500 company total return index. (source: Morningstar.com through 11/2017)

Going forward, my expectation for both technology and healthcare sectors will be to outperform the S&P 500. My thesis is based on strong growth forecasts, relative value analysis and long term outperformance for companies with higher ROE and high gross product margins.

The higher historical returns have also come with higher volatility. The risk (as measured by monthly standard deviation of returns) was .10 for the S&P 500 index compared with .14 for VGT and .13 for healthcare.

What Happens When We Add Both Technology and Healthcare Together?

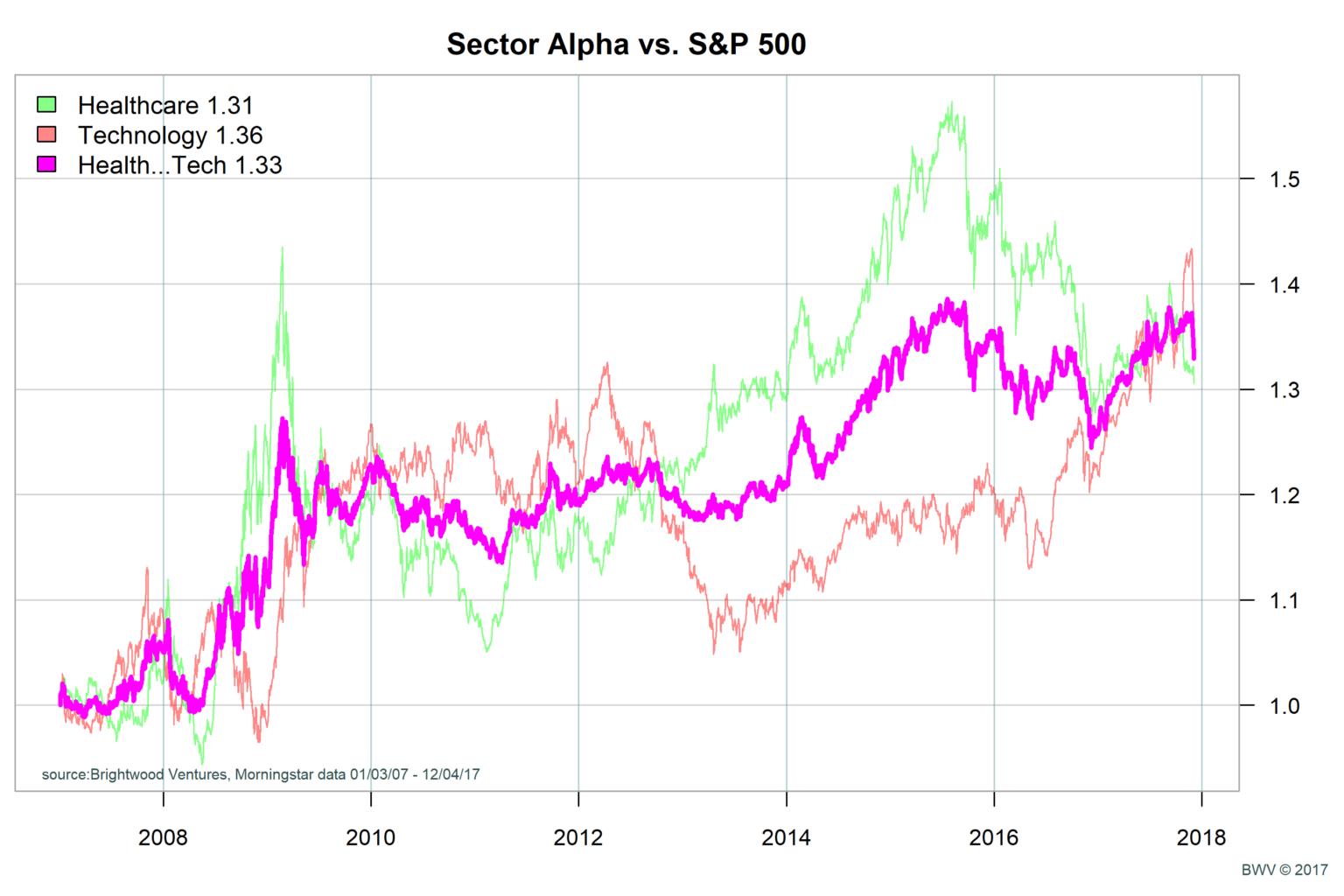

Healthcare as a sector tends to be defensive. By this we mean than it is not as sensitive to large changes in economy. The idea being that demand for drugs and healthcare services is pretty steady. Technology, on the other hand, is considered to be sensitive to changes in the economy. The following graph shows 10 years of data for total returns for Vanguard Information Technology fund (VGT) and Vanguard Healthcare fund (VHT). In addition, we simulate a portfolio that holds 50% VGT an 50% VHT.

From the graph we note that there are periods where healthcare and technology are moving in different directions. In fact, over this period, we found that the monthly return correlation between the pair is -.4. Why would this be the case? As noted above, healthcare stocks tend to be less linked to the economy. If investors fear on the economy goes up, it would be reasonable to expect that technology may suffer and a rotation to healthcare stocks may drive the price up. While there is no assurance that the pattern will repeat in the future, there is a reasonable economic rationale that explains why the diversification may exist.

In the following table I want to provide some additional statistics to show how the diversification generates very similar returns at lower risk compared to either sector alone.

| yr | mean | sd | shrp | cagr | cvar | up.cap | dn.cap | |

| Heathcare | -0.001 | 0.027 | 0.104 | 0.263 | 0.025 | -0.043 | -0.075 | -0.297 |

| Technology | 0.124 | 0.032 | 0.091 | 0.355 | 0.028 | -0.044 | 0.234 | 0.158 |

| 50/50 | 0.055 | 0.027 | 0.069 | 0.398 | 0.026 | -0.024 | 0.066 | -0.074 |

source: Brightwood Ventures, LLC analysis, Morningstar

This table is presenting the excess return for the sectors compared to the S&P 500. So, the way we read this, heathcare has essentially generated the same return as the S&P 500 for the past year while technology has outperformed the S&P 500 by 12.4%. The excess return to healthcare and technology has been 2.5 and 2.8%, respectively. However, notice the standard deviation (sd) column. This is standard deviation of the return difference. Healthcare and technology return difference to the S&P 500 is .104% and .091%, respectively. However, if we combine the two sectors together, we see that the long term excess return is .026, close to the return of either healthcare or technology stand alone. However, we see that the risk (sd) drops to .069. This shows that the negative correlation helps to reduce the standard deviation of the return difference when we combine the two sectors. We also see a similar result in the CVAR column. CVAR is the conditional value at risk @ 10%. The way to read this, we say that there is a 10% chance that we experience a negative monthly return difference of -2.4% or greater. As with the risk (sd), we see that CVAR is much lower for the blended healthcare + technology scenario compared to either sector alone.

This analysis shows that historically combining technology and healthcare would have generated returns over the S&P 500 with less risk then holding either sector by itself. I believe it is reasonable to expect the negative correlation to hold in the future and given positive relative value for technology and healthcare, diversification benefit adds another reason for overweighting these sectors at the same time.