With this final part 3 we will explore three topics. We’ll look at tax costs of the fund, the management of the fund and premium analysis available at Morningstar.

Taxes

So far, we have reviewed fund performance and risk on a pre-tax basis. If you plan on holding a fund in a taxable account the tax considerations are very important. Generally, the more ‘actively managed’ a fund is, the higher the tax cost for the fund. A fund which actively trades stocks is more likely to be exposed to realized capital gains. In addition, the structure of the fund makes a difference. As previously discussed here, we noted that holders of exchanged traded funds experience taxable gains when they sell shares. In contrast, mutual fund shareholders can be exposed to capital gains even when they do not sell their shares.

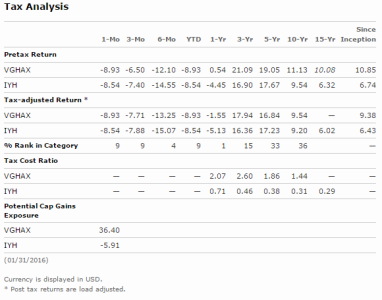

In this section we’ll explore tax cost analysis by comparing the Vanguard Healthcare fund with the iShares US Healthcare Fund (ticker = ‘IYH’). The iShares fund is a passively managed fund and structured as an exchange traded fund. For this discussion, I use data from Morningstar found by navigating to the ‘tax’ tab and then adding the ticker ‘IYH’ by selecting the ‘compare’ button. The page can be found here.

From the table, let’s look at the data from the ’10-Yr’ column and review the line items called ‘Tax-Adjusted Return’ and ‘Tax Cost Ratio’. According to Morningstar data definitions:

‘The tax-adjusted return shows a fund’s annualized after tax total return for the five- and 10-year periods, excluding any capital-gains effects that would result from selling the fund at the end of the period. To determine this figure, all income and short-term capital gains distributions are taxed at the maximum federal rate at the time of distribution. Long-term capital gains are taxed at a 15% rate. The after tax portion is then reinvested in the fund. State and local taxes are ignored, and only the capital gains are adjusted for tax-exempt funds, as the income from these funds is nontaxable.’

Note that the definition for tax cost assumes the maximum marginal tax rate for income and short-term capital gains. This may overstate the tax cost for those that fall below the top marginal rate. Also note that the figure does not include state taxes. This would understate the tax cost for those living in high tax states such as Oregon and California.

From the table we see that the Tax-Adjusted Return for 10-Yr is 9.54% annualized vs. 11.13% annualized Pretax Return. The Tax Cost Ratio is 1.44%. For the 10-Yr period the investor would have received a return of approximately 9.69% after taxes (11.13% minus 1.44% = 9.69% annually). Note the actual annualized would return would be slightly lower due to compounding. The key take-away is that taxes would reduce returns over the period by almost 1.5%.

What about the iShares US Healthcare ETF? The tax cost ratio for this fund was just .31%. This can be explained based on slightly lower returns, less active management and possibly differences between the fund format (ETF vs. mutual fund).

In part II we saw that the Vanguard Healthcare Fund had an excess return or alpha of 1.9%. Here we see that the difference in tax cost compared to the iShares US Healthcare fund of 1.44% – .31% = 1.13%. If the Vanguard Healthcare Fund was held in a taxable account we see that almost 60% of the alpha would be lost to taxes! (1.13% / 1.9% = .594).

The conclusion? First, taxes place a large burden on actively managed funds. Second, if we are going to hold a fund like Vanguard Healthcare Fund (or any actively managed fund) we would be more tax efficient to hold those funds in a tax deferred account. For this reason, as an advisor we place a good deal of attention on tax location — putting the right assets in the right type of funds to minimize tax burden.

Management

Morningstar’s web site also provides background on the fund managers. Navigate to the ‘management’ tab from the Morningstar site and the following page can be found. Generally, the data found here includes prior experience, certifications and education. A number of studies have attempted to understand if manager tenure and/or education can be used to predict performance. One study from MIT found that the quality of the undergraduate institution, as measured by SAT scores, may predicted excess returns. For details, the paper can be found here. Generally, I’d like to see a proven track record, an MBA from a top school such as Wharton or University of Chicago and/or a CFA certification. The CFA certification can be thought of as a ‘masters in finance’ with emphasis on valuing securities and portfolio management.

Additional Premium Content

In this article series we have focused our discussion on free content available from Morningstar. In addition, I included performance regression analysis conducted by Brightwood Ventures. I wanted to draw attention to additional premium content available from Morningstar. Morningstar’s premium service gives the user greater depth and analysis into the fund. In particular, the company does a good job of analyzing the fund investment process and stewardship. Prior to investing in any fund, the reader may wish to consider the premium services or seek out the Morningstar analysis from an advisor that subscribes to the Morningstar institutional data.

Conclusion

In this series we have explored the Vanguard Healthcare Fund. We see that the fund is actively managed and includes heavy allocation to the pharmaceutical sector. The fund also holds 15% in the biotech sector. Using performance analysis, we showed that the fund has produced a ten year alpha of roughly 1.9% (greater than 90% confidence). We discussed fund expenses and the fact that low expenses may be the single best predictor of future excess returns. This fund’s expenses are ‘low’ relative to funds in the healthcare category. Finally we looked at tax costs. We see that there is an impact from active management and/or the mutual fund structure. Much of the excess return the fund is generating could be reduced by taxes. As such, this fund would be best held in a tax deferred account such as a 401(K) or IRA.

Disclosure: As of 2/15/2016, Brightwood Ventures model portfolios include an allocation to the Vanguard Healthcare Fund. The analysis included with this series in an illustrative example of the types of methods Brightwood Ventures uses to formulate a ‘reasonable basis’ for holding this type of fund. The discussion in this article is not an investment recommendation. Investors should have a financial plan, investment allocation and investment implementation plan that is unique to their situation.