Our model portfolio process includes periodic review and short term tactical allocation decisions based on market conditions. In this article, I will focus on my current thinking regarding model portfolio bond allocation. In particular, the primary questions relate to interest rate risk with respect to the anticipated interest rate hikes.

Overall Allocation

Recently I have written about expected equity returns here. Based on both absolute and relative value metrics I see the stock market as being fully value, but not in a bubble. Yes PE ratios are high from a historical level, but interest rates are low and are likely to stay this way for some time. That said, given future expected returns of 5-7%, I don’t see a good argument for overweighting equities. As for bonds, in the long run, we like the diversification benefit. In the short run, the primary concern is impacts from rising rates. Should we hold our existing allocation move to cash?

Bond Pricing Primer

We know that bond prices fall when interest rates rise. This point can be very confusing to investors. Here is a simple way to think about it. Say you buy a 4% bond today and pay the current market price. Tomorrow the market rates for interest jump to 5%. Why would your bond be worth less? Well think about trying to sell your bond. If a new buyer can buy a bond that is paying 5%, why would they pay you full price for your bond? They would be willing to buy it from you, but at a discount. In order for the investor to get the equivalent value of the new 5% issue, they could buy your bond at a discount. They will get lower coupon payments from the bond, but when the bond matures they would get back a principal amount greater than what they paid in. The pricing for your bond should normalize to that price that would make a new investor indifferent about buying your bond. We use the metric called ‘duration’ to provide an estimate for how much a bond price will fall based on a small change in interest rates. Say the rates go up .5% and the duration of a bond is 5. We would expect a loss of 2.5%. Generally, the duration of a bond is less than the maturity of a bond.

Bond Allocation and Tactical Allocation Decision

Given that we want to hold equity allocation at the model level our primary questions for our bond allocation are: 1) should we hold bonds or cash and 2) should we choose passive investments or active investments. As described previously, funds which attempt to beat an overall market index by making asset selection decisions are called ‘actively’ managed. In that article I described a technique to evaluation whether an active bond fund has produced excess returns.

Let’s say that we all agree that we expect bond interest rates to go up in the next few years. This alone does not argue for trying to actively manage bonds. Why not? There are two big problems. First, we would have to get the timing right. When exactly will rates change? The second question is ‘what will the change in rates look like’? If the rates rise very slowly and don’t change significantly, then any downside risk we face could be low relative to the return we get by staying invested.

How do bond manager’s attempt to generate excess returns over their benchmark? Bonds are not a homogeneous asset class. Bonds may be short term or long term. Bonds are issued by the government (deemed relatively safe), from corporations (depending on the credit risk the bonds could vary in risk) or from financial institutions (e.g. mortgage or asset backed securities). In short, there are a wide range of determinants including duration, sector, quality and relative spreads (differences) in interest rates across these categories.

Forward Looking Expectations

Given a slow growth economy and relatively low inflation expectations, I tend to subscribe to the view that rates will not go up violently. I believe the most likely scenario will be that rates at the short end of the interest rate spectrum will rise more quickly than at the intermediate and long end of the bond maturity spectrum. My expectation is that the volatility in the bond market creates opportunities that an active bond manager can capture. Currently, we are using both Pimco Total Return Active Bond Fund (BOND) as well as Pimco Income Institutional Fund (PIMIX).

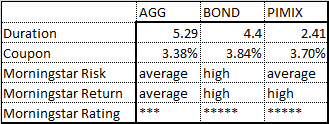

Let’s take a closer look at how these funds differ and the types of active management they are currently using. We will use Barclay’s Total Bond Market as the benchmark index. As a proxy for statistics, we’ll use the iShares US Aggregate Bond Fund (AGG). Unless noted, all data in this paper is sourced from Morningstar Research and is current as of 6/15/2015.

Let’s take a closer look at how these funds differ and the types of active management they are currently using. We will use Barclay’s Total Bond Market as the benchmark index. As a proxy for statistics, we’ll use the iShares US Aggregate Bond Fund (AGG). Unless noted, all data in this paper is sourced from Morningstar Research and is current as of 6/15/2015.

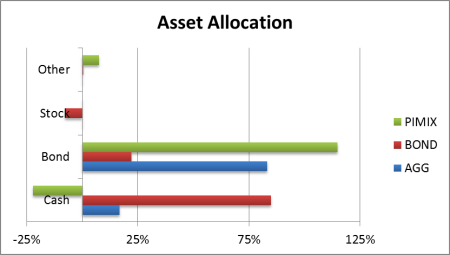

Asset Allocation

Active bond managers’ have a number of tools they can use to generate excess return. Deciding on weighting between cash and bonds is a primary tool they use. If bonds are not attractive, they can take a portion of their funds and just hold cash.

In the figure to the right we can see have the allocation weights for the three funds. The benchmark fund, AGG is currently weighted about 85% in bonds and 15% in cash. In recent months, the Pimco Bond Fund has reduced it’s allocation to just 22% bond weighting. Meanwhile, the Income Fund has an allocation of 115% bonds and -22% cash. How is it possible for the Income Fund to have a weighting in bonds above 100%? It means the fund is using leverage. The fund borrows funds and invest those funds in bonds or other derivatives such as futures an forward contracts that give it a net exposure greater than it’s invested assets.

In the figure to the right we can see have the allocation weights for the three funds. The benchmark fund, AGG is currently weighted about 85% in bonds and 15% in cash. In recent months, the Pimco Bond Fund has reduced it’s allocation to just 22% bond weighting. Meanwhile, the Income Fund has an allocation of 115% bonds and -22% cash. How is it possible for the Income Fund to have a weighting in bonds above 100%? It means the fund is using leverage. The fund borrows funds and invest those funds in bonds or other derivatives such as futures an forward contracts that give it a net exposure greater than it’s invested assets.

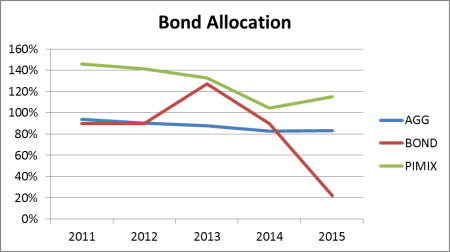

In the chart to the right, I plotted the bond allocation weight vs. time. We can see that the iShares US Aggregate Bond Fund (benchmark) has held a stable % of bonds (as we expect, as this is a passively managed benchmark). The Total Return Fund and the Income Fund vary their bond allocation considerable more than the passive index fund.

In the chart to the right, I plotted the bond allocation weight vs. time. We can see that the iShares US Aggregate Bond Fund (benchmark) has held a stable % of bonds (as we expect, as this is a passively managed benchmark). The Total Return Fund and the Income Fund vary their bond allocation considerable more than the passive index fund.

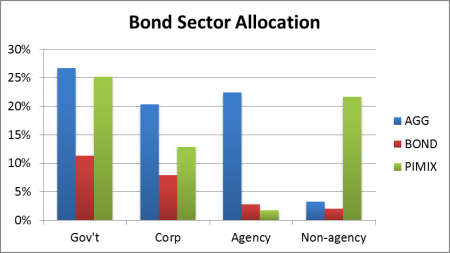

Sector Allocation

A second way the fund manager can add value is by selecting bonds from sectors in a different mix than that found in the passive index. In the chart here we see some substantial differences in the bond sector allocation that each fund is currently invested in. The benchmark fund holds a balanced mix of government bonds, corporate bonds and mortgaged-backed securities issued by agencies of the federal government. (Barclay’s US Aggregate Bond Fund Index reflects the market value of US investment grade bond market).

We can see that the Total Return Fund is under-weighted in all of the sectors included in the chart. (The chart allocation % includes cash as a category). Note that the Income Fund has a substantially higher weighting in non-agency securities. This category includes mortgages that are not backed by a US agency as well as other securitized debt instruments (such as auto loans, credit card debt etc,)

We can see that the Total Return Fund is under-weighted in all of the sectors included in the chart. (The chart allocation % includes cash as a category). Note that the Income Fund has a substantially higher weighting in non-agency securities. This category includes mortgages that are not backed by a US agency as well as other securitized debt instruments (such as auto loans, credit card debt etc,)

Duration

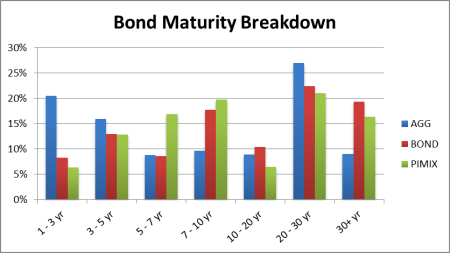

This next chart shows us the breakdown of the maturities of the bonds that each fund holds. Here we see some significant differences. First, note that the benchmark fund has a high weighting of short term bonds, those 1-5 year range. When the Fed begins to raise rates, most expect that the rates on short term bonds will rise the most. These are the bonds which may be impacted the most (subject to duration scaling) compared to the long term bonds. From the chart we can also see that the Pimco Funds both have a substantially higher weighting in long-term bonds. These bonds have higher duration and would be expected to experience more volatility with a given change in interest, but historically the rates at this end of the interest rate curve are more stable.

This next chart shows us the breakdown of the maturities of the bonds that each fund holds. Here we see some significant differences. First, note that the benchmark fund has a high weighting of short term bonds, those 1-5 year range. When the Fed begins to raise rates, most expect that the rates on short term bonds will rise the most. These are the bonds which may be impacted the most (subject to duration scaling) compared to the long term bonds. From the chart we can also see that the Pimco Funds both have a substantially higher weighting in long-term bonds. These bonds have higher duration and would be expected to experience more volatility with a given change in interest, but historically the rates at this end of the interest rate curve are more stable.

Quality

High yield or junk bonds are those bonds issued by companies that have weaker financial health than investment grade companies. The active manager can use these bonds to increase returns. However, in times of financial stress, these bonds can experience large drops and generally under-perform investment grade bonds.

The bond index does not include a material portion of high yield bonds. According to Pimco’s web site, the high yield allocation for the Total Return Fund and the Income Fund were 4% (May 31, 2015) and 15.6% (March 2015), respectively.

Conclusion

In this paper, we reviewed the types of investment decisions active bond fund managers make. We explored those decisions by reviewing the Pimco Total Return Fund, the Pimco Income Fund and we contrasted those with the iShares US Aggregate Bond Fund (as a benchmark).

Given our outlook that interest rates will experience moderate increases over a long period of time, coupled with the superior active risk-managed returns that Pimco has demonstrated, we will continue to weight bonds according to our model portfolio. We continue to use a mix of both active and passive bond funds with a bias toward the actively managed funds, including both the Total Return Fund (BOND) and the Income Fund (PIMIX).