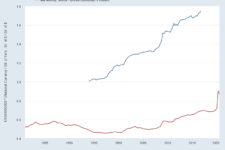

Yield Curve Inversion

(Photo:

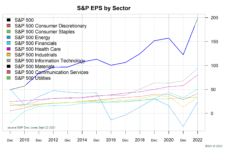

• Ten Year Treasuries touched 5% on October 19th, up 1.43% since Jan 1. • Two-year rates exceed ten-year rates in July of 2022 (yield curve inversion). • In the past, yield curve inversion has always signaled recessions. • The recessions typically have occurred 18-24 months after inversion. Over the course of the past months, […] Read the full article…