Q3 earnings season is nearly complete with 90% of the S&P companies having reported. For Q3, 75% have beaten their earnings forecast. Sales forecasts were exceeded in roughly 60% of the reports. Operating margins have been under some pressure. QTD, operating margins stand at 11.34% vs. last years 12.13%. Still, the Q3 2018 margin was the highest it’s been in years.

Q3 earnings season is nearly complete with 90% of the S&P companies having reported. For Q3, 75% have beaten their earnings forecast. Sales forecasts were exceeded in roughly 60% of the reports. Operating margins have been under some pressure. QTD, operating margins stand at 11.34% vs. last years 12.13%. Still, the Q3 2018 margin was the highest it’s been in years.

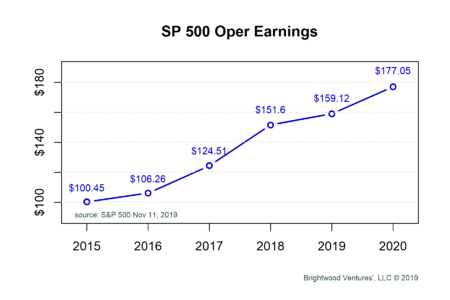

Year over year, Q3 earnings are down about 2.7%. For 2019, if Q4 forecasts are met the year over year growth in earnings for the S&P 500 would be 5%. Total year earnings are now projected to be $159.12 per share.

Another interesting point about 2019 is the size of the share buyback yield. The current buyback yield on the S&P 500 is estimated to be 4% according to S&P Dow Jones. This is a recent peak. We learned in my last post that companies tend to announce buybacks when they have had recent weakness after prolonged positive performance. Could it be that companies are anticipating a recession in the near future and are relying on buybacks to reflate share price and deliver on earnings expectations?

The Q3 earnings season also helps to refine company and analyst earnings growth estimates for the next year. Prior to Q3, the forecasted bottoms up growth for 2020 was estimated to be a very unrealistic 20%. With updated guidance provided from the recent reports the forecast for 2020 has come been cut almost in half. Earnings are forecasted to be $177.05 for the S&P 500 or +11.13%.

Even with a 4% buyback yield my sense is that the growth projects for next year are still too optimistic. I expect that operating margins will remain under pressure given constrained employment. Let’s say sakes growth remains weak. Take the 4% buyback tailwind and add in 3-4% growth at constant margin and a more realistic earnings growth year over year feels much closer to 6% then 11%.

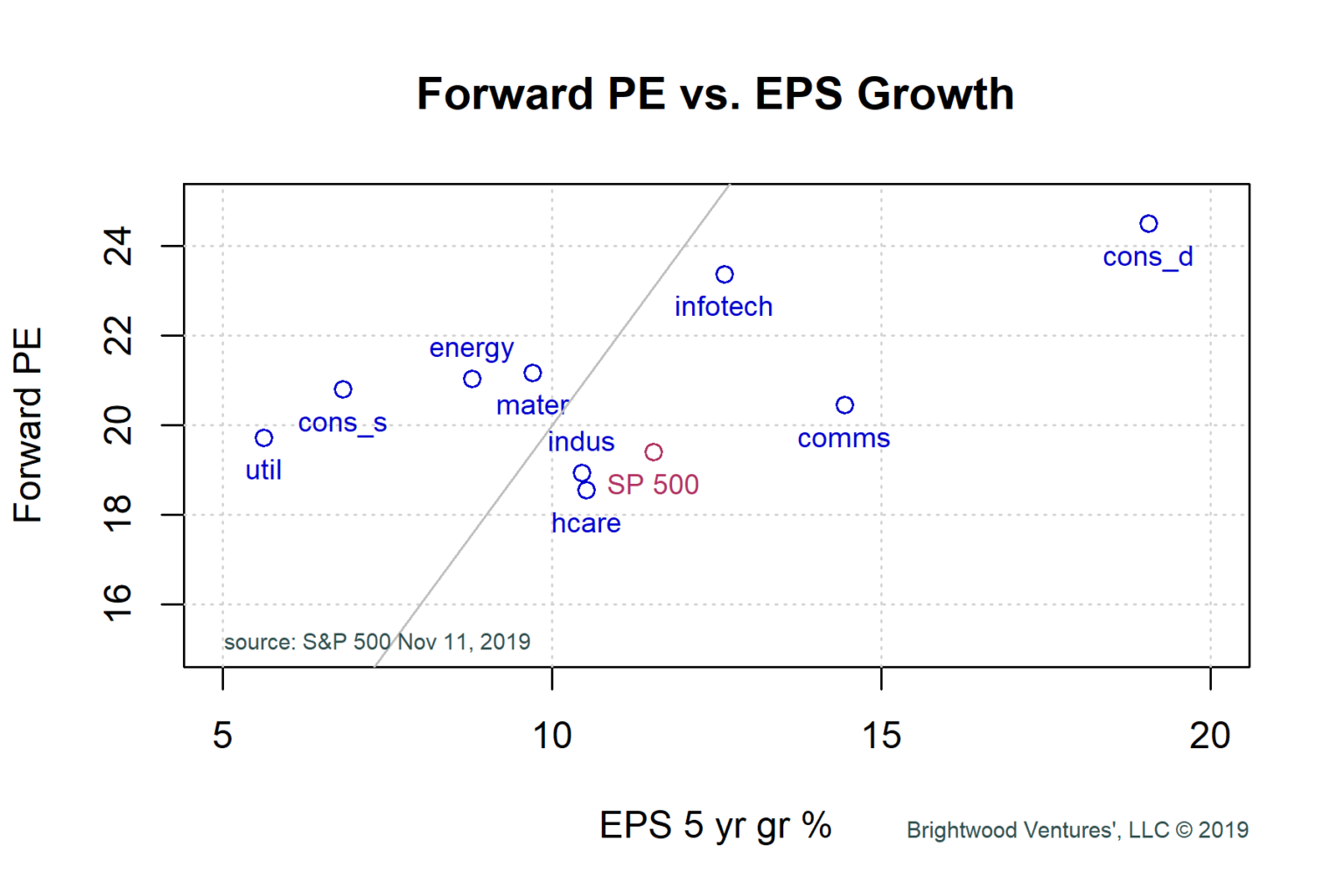

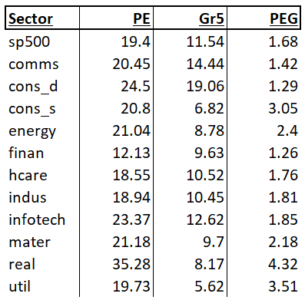

Turning to stock sector growth and prices, we can see recession concerns have pushed PEG ratios (PE divided by Growth) for utilities, real estate and consumer discretionary sectors above 3.0. These sectors are considered safe haven investment when growth is slowing and inflation is in check. I’d rather balance fixed income or cash with quality stocks to mitigate risk than overpay for these defensive sectors. The communication services sector looks attractive, but I question the 14% growth assumption. I continue to like the combination of healthcare and tech due to the non-correlated returns. Consumer cyclicals aren’t cheap and will decline more in a full recession. A small allocation to the highest quality cyclicals would still be reasonable in growth-oriented portfolios.

Recession clouds, trade tensions, slowing global growth and the US election next year will continue to be a concern. The forward PE for the S&P at ~19, is stretched relative to its recent 3-5 range. With a 5.26% earnings yield and inflation at 1.8%, the real earnings yield premium is just about 3.5%. This is in line with historical averages. Again, assuming earnings hold up and inflation stays in check. Downside risk is higher than upside at this point so, stay diversified and bias toward quality earnings.