In his recently released 3rd edition of “Irrational Exuberance,” Nobel Prize winning economist Robert Shiller asserts that, “This is not the golden age for investing and we shouldn’t assume that it’s going to be as it always was.” The historical assumption of 10% market returns may not hold true for the future. The core argument behind this is that the economic growth going forward may not match the past. Shiller asserts that, “people are holding on to old facts, old presumptions” and he talks specifically about the assumption that 5% savings rate is enough to build a retirement upon.

I thought it would be interesting to look at the savings rate issue more closely. Let’s first assume that we are operating in the past, using a 10% return model. I created a simple model that shows what your retirement portfolio would look like assuming you start working at age 20 and retire at age 65. It assumes $50,000 as the starting income. Furthermore, it assumes you need 75% of your pre-retirement income at the point you retire. I use nominal returns and assume income and spending grow at 4%. I kept the model simple, excluding taxes and social security. Keep in mind this is an illustrative example, when we model retirement for clients we use a much more detailed model that takes into account their unique situation, including taxes, etc.

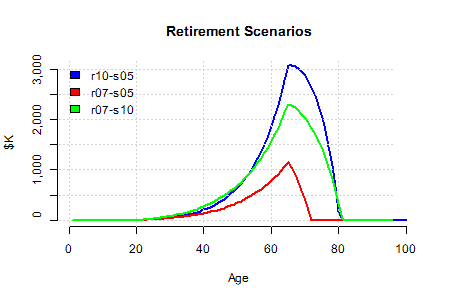

In the figure above, you can see that using the base scenario (color = blue) one would build a portfolio of about $3M and would run out of money just after age 80. (For this reason, I think even the 5% assumption, as discussed by Shiller, is too low, but lets carry it forward to match the figures Shiller was using).

Now what happens if we assume that portfolio return drops to 7% and inflation stays where it is today, around 2? The red line in the figure represents this scenario. You can see that the retirement portfolio would run out just after age 70. (You may note also that the portfolio peaks at a much lower level, this is because we assumed a lower investment rate and we assumed the income growth rate matched the lower inflation rate).

What would it take to reach the same level of retirement funding (age 80)? Well, you would have to double savings to 10% just to reach the same point (green line in the figure above). What is the take away? Well clearly, changing the assumptions has a huge impact on the outcome. If you believe the future returns will not return to historical levels quickly, then there are several choices one could make to maintain retirement safety. One could save more now, spend less in retirement or arguably take more investment risk. The problem with taking more investment risk is that it ultimately reduces the probability of hitting your retirement goals. As they say, ‘there is no free lunch’.

If you’d like to get a better understanding of where you stand based on your income, saving and portfolio values, contact us and we can build a model that is right for you.