Today I’d like to discuss the impact of currency appreciation on international stocks. Let’s focus on developed-country stocks and the MSCI EAFE Index. EAFE stands for Europe, Australasia and Far East. Furthermore, we use several exchange traded funds (ETFs) to help with the illustration.

US Stock vs. International Stocks, YTD

Our first chart is the total return of the iShares US S&P 500 IVV vs. the total return of the iShares MSCI EAFE EFA. According to Morningstar, the total return, year-to-date through Aug 21, for these funds is 16.49% and 9.69%, respectively. International developed-country stocks have beaten the U.S. stocks by a wide margin this year. Why?

Currency Discussion

As a general rule, funds which hold international stocks do so based on the local currency associated with the country where the stock trades. For example, the top five holdings of the EFA include Nestle, HSBC and Toyota. These stocks trade in Swiss Francs, British Pounds and Japanese Yen. The total value of the ETF is derived and presented in US dollars.

When we look at the return for international stocks we need to be aware of the currency impacts on return. In recent years, international funds with currency hedging have become available. In a currency hedged fund, the manager attempts to remove the currency impacts on return by hedging the underlying currency vs. the US dollar. Typically, this is done using currency futures or forward contracts.

Recent Currency Appreciation/Depreciation

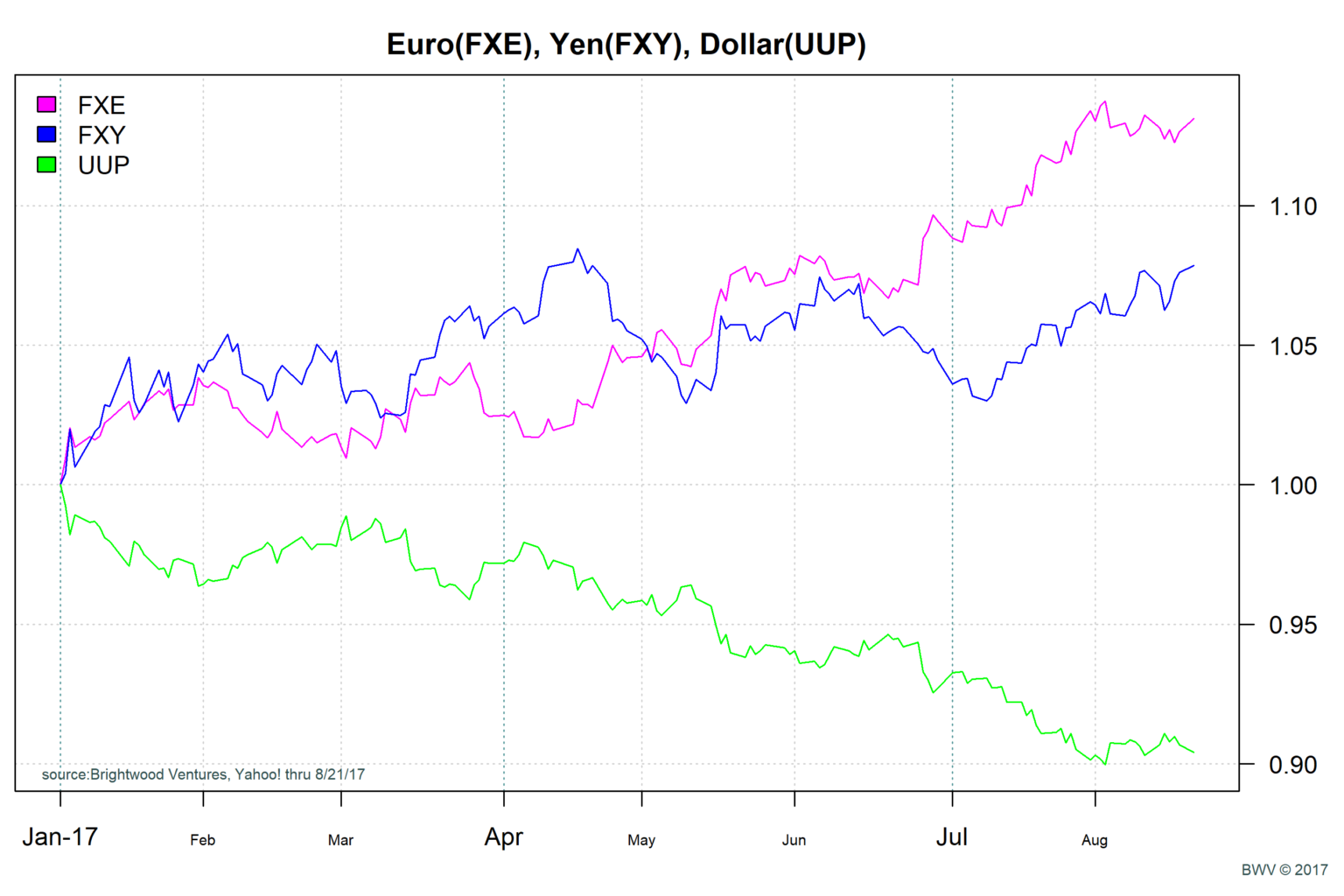

Let us look at several exchanged traded products that are designed to track various currencies. FXE is the Guggenheim Euro Trust ETF design to track the Euro. FXY is the Japanese Yen ETF. Finally, UUP is the PowerShares US Dollar Index Bullish ETF. The UUP tracks the dollar vs. a basket of six large currencies including the Euro, the Swiss Franc, The British Pound and the Japanese Yen.

From the chart we can see that both the Euro and the Yen ETFs have had strong appreciate vs. the US Dollar. We see that UUP (-8.77%) has declined against a basket of currencies. FXE is up 11.64% and the FXY is up 7%.

International Currency Hedged Performance

From the last chart, we see that the US Dollar has depreciated against other major currencies. The Euro has put in a strong performance against the dollar. How does this show up in fund returns?

One way to look at the impact is to plot both the hedged and unhedged version for the iShares MSCI ETFs. In this next chart, we plot HEFA along with the EFA and IVV. HEFA tracks the same index as the EFA, but it attempts to hedge the currency impacts of the underlying securities.

One way to look at the impact is to plot both the hedged and unhedged version for the iShares MSCI ETFs. In this next chart, we plot HEFA along with the EFA and IVV. HEFA tracks the same index as the EFA, but it attempts to hedge the currency impacts of the underlying securities.

From this chart we get an interesting picture. We see that in local currency terms (assuming that the hedges were 100% effective) that International stocks have slightly under-performed the US S&P 500 in terms of the US Dollar. Most all of the excess return to EFA over the IVV has come from currency impacts!

Predicting the direction of currencies is very difficult. Currencies tend to trend for long periods of time but also revert over time. The dollar has been in a long term strengthening trend for years, but has reversed direction this year. From the fund returns, we can see that currencies can have a major impact on returns when looking at performance over the short run.