According to data from Envestnet, many American’s used their stimulus checks to trade stocks. As reported by CNBC, Envestnet estimated that those earning between $35,000 and $75,000 increased stock trades by 90% in the week after they received their stimulus check. Checks went out beginning the April 13. Since April 13, the S&P 500 is up over 10%.

Consumers also used the money for savings, bill paying and home improvements.

In addition, a large number of new brokerage accounts have been opened this year. Robinhood has seen over 5 million new accounts since the beginning of the year. Large increases in account openings have also been reported by brokerage firms such as Schwab.

There are many things that could explain the rapid acceleration in stock prices recently. Certainly, demand from retail traders looks to be one of the primary causes, along with re-opening states and very dovish policies by the Fed.

Meanwhile, I was reviewing stocks earnings estimates and valuations, and at this point it looks like the stock market has gotten ahead of itself. Or at least what we can say is that the top stocks seem to be priced for perfection if we look at earnings and PE ratios.

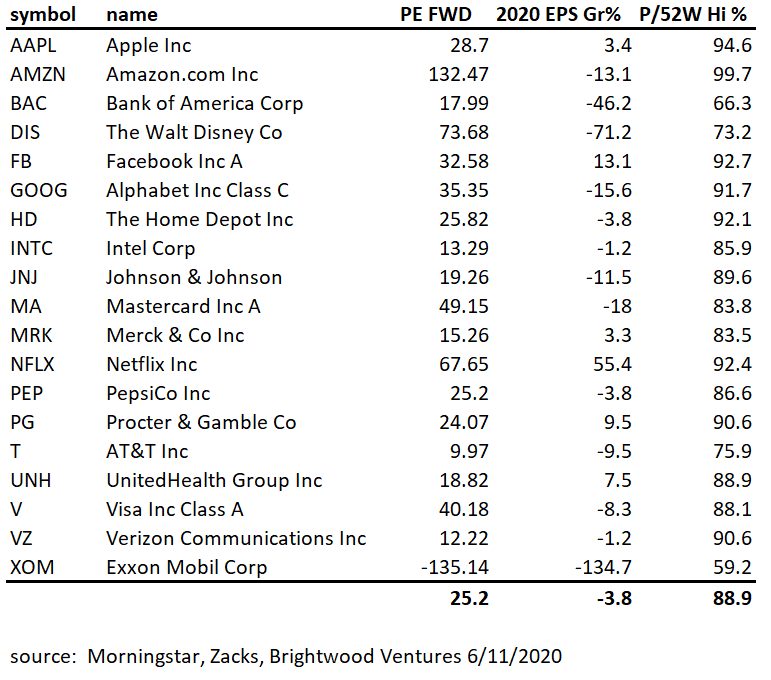

Let’s just look at the largest 25 stocks in the S&P 500 index. For example, Apple. Based on data from Morningstar and Zacks we see that Apple is trading at a price to earnings multiple of 28.7. This is based on prices from June 10 and using the earnings estimates for the company for 2020. In the second column, I calculated the change in earnings comparing current 2020 estimates vs. 2019 actual earnings. Analysts are forecasting that Apple earnings will grow 3.4% in 2020 over 2019. Finally, the last column shows the price relative to the 52-week high. Apple is trading at 94.6% of its recent 52-week peak.

On the final row, I took the mean value of each of the columns. While analysts are expecting a large range of earnings growth for the individual companies ( -35% for XOM to +55% for NFLX), the median growth for earnings is -3.8%. The median forward PE ratio is 25.2. This is very expensive relative to the past 5 years. The forward PE ratio had been in the 18-22 range. We can also see that the stocks are trading at a median price to peak 52-week high of about 89%.

What really stands out to me in addition to the high PE ratio is that the current earnings estimates are very close to 2019 levels. How can this be? It’s as if we had no economic shutdown (not to mention civil unrest). Earnings forecasts are estimated by analysts that work for large banks. These analysts are all ‘sell side’ analysts. That means that they work for banks that create analyst reports used by their brokers to sell stocks. Why haven’t the estimates come down very much? I have a few theories on this. First, most of the companies are not reporting guidance. Analysts are generating their own estimates of earnings. Second, there is a widely held belief that the economy and earnings will bounce back very quickly. History shows us that sell-side analyst estimates always start out very optimistic and are reduced as the earnings reports draw near. Is it possible that the earnings impact will be greater than the analysts are forecasting? Earnings fell in Q1 and GDP is expected to decline 40-50% in Q2. Even if the market immediately recovers in Q3, the earnings hit from Q1 and Q2 will result in a larger decline then 3.8%.

Given the earnings estimates for growth between 2020 over 2019 being essentially flat and combined with recent stock returns, the market now looks to be at extreme PE multiples relative to history. Yes, it is true that lower interest rates drive asset price inflation and as noted above, the stimulus money is flowing into demand for stocks. Does this mean that stock prices will remain permanently elevated? It is difficult to say, but as of today it sure looks like we are priced for perfection.